GoMining News

All links in 1 click - https://link3.to/gmt_token

Join the biggest community of miners: https://t.me/gmt_token_talk

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

? Upcoming AMA ⛏️?

Join CEO Mark Zalan for the official 2024 GoMining Recap AMA.

2024 has been an incredible year for GoMining, and now it’s time to reflect on the milestones we’ve hit and what’s ahead for 2025.

? Date: December 30th, 2024

⏰ Time: 2 PM UTC

Set your reminders!:

https://x.com/i/spaces/1OwxWNVgZyMJQ

Congratulations to this month’s token raffle winners! ⛏️?

1st place: 1,000 GOMINING

2nd place: 300 GOMINING

3rd place: 100 GOMINING

4th place: 100 GOMINING

Check our X (GoMining_token) to see who won!

Winners, please send us your GoMining ID by tomorrow to receive your tokens by January 6th.

Tokens will be sent after January 17th if you miss the deadline to submit your ID.

Next month’s raffle is on the way—don’t miss it! ⛏️?

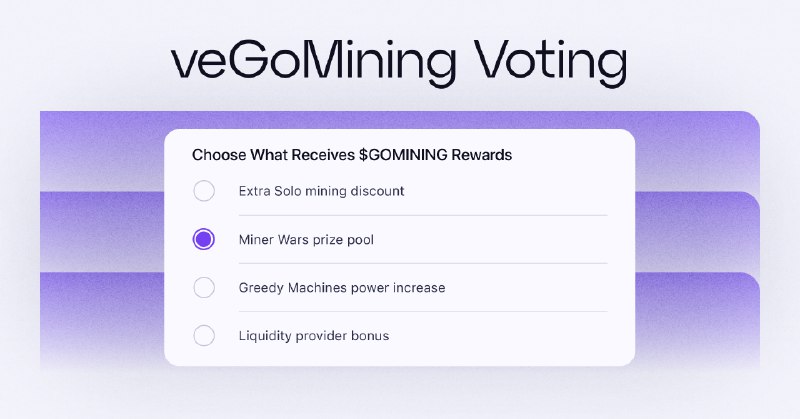

? Your Vote Matters ⛏️?

GoMiners make decisions together.

Holding $GOMINING means you get to vote and participate in governing the protocol.

?All you need to do is get some $GOMINING and lock 'em!

All veGOMINING vote owners decide where they want GoMining rewards (10% of weekly emission) to be distributed ⛏️?

Here are the options:

?Extra Solo mining discount

?Miner Wars prize pool

?Greedy Machines power increase

?Liquidity provider bonus

?️ Cast your vote & decide where you want GOMINING rewards to go!

? 2 Million users already earning with GoMining! ?

We're glad to announce that over 2 million users are already earning with GoMining! Thank you for being part of our growing community. Let's keep mining and earning together! ?

? Reminder! The KuCoin AMA with GoMining starts in 1 hour! ? ? Don't miss GoMining CEO Mark Zalan & KuCoin's Dorian Vincileoni discussing Bitcoin's future, recent halving impacts, and GoMining's tokenomics. ? Win $555 in GOMINING tokens & 3 NFT Miners! Submit…

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago