Aura Finance: Announcements

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 3 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

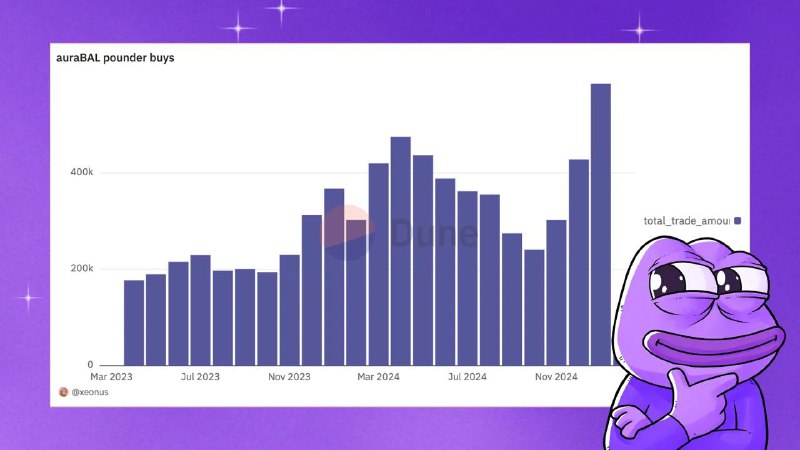

All Time High!

$585,144 of protocol fees were used to buy back auraBAL in January.

Staked auraBAL in the Compounder is now earning a solid 41% vAPY.

V3 transform …](/media/attachments/aur/aurafinance/558.jpg)

Boosted Pools on @Balancer V3 transform $USDT and @ethena_labs’ $USDe into yield-generators by leveraging @aave's lending markets.

The efficiency of a vanilla USDe | USDT pool but with both assets earning yield and amplified on Aura.

pools …](/media/attachments/aur/aurafinance/556.jpg)

Check out these two @usdx_money pools on Arbitrum 👀

USDX | USDT https://app.aura.finance/#/42161/pool/94

sUSDX | USDX https://app.aura.finance/#/42161/pool/93

USDX has rapidly grown to over $600m of TVL though delta-neutral basis trading & delivering yields to sUSDX holders.

Five new Gyroscope pools are now receiving incentives on Aura!

Gyro Scope’s E-CLPs enable increased trading fees from concentrated liquidity without needing manage your own liquidity range.

And as always, amplify your liquidity on Aura ?

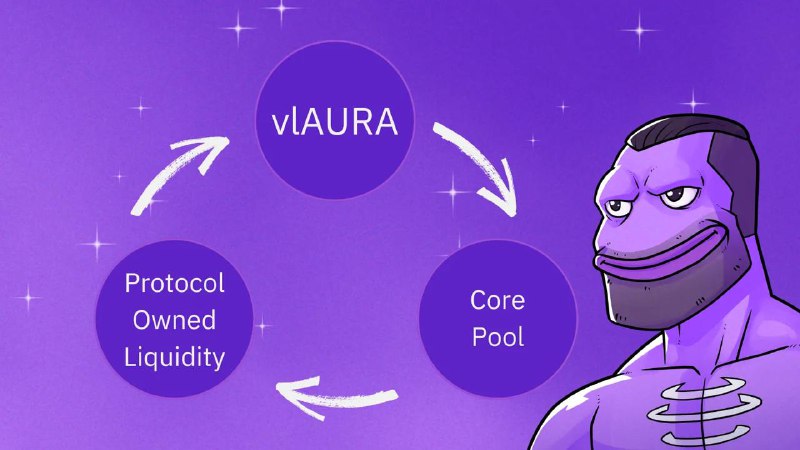

For pools that qualify as a Balancer Core Pool, 37.5% of trading fees are redirected to veBAL and vlAURA voters.

Combining Core Pool status with protocol owned liquidity and a strategic vlAURA reserve turns liquidity from a cost to a revenue generator.

How does this work? ⬇️

The most common way to qualify as a Balancer Core Pool is for at least 50% of the pool to contain yield bearing assets or use an 80/20 pool for governance token liquidity.

Attaining Core Pool status initiates a cycle where 37.5% of trading fees are redirected to veBAL and vlAURA voters. This aligns incentives within Balancer where emissions can flow to where they’re most valuable.

For protocols that own some of their own liquidity, Core Pool status allows them to earn trading fees along with $AURA and $BAL emissions, without the need to incentivize pools themselves.

When you add a strategic vlAURA position on top, it supercharges the flywheel. Liquidity doesn’t have to be expensive!

Amplify your Liquidity on Aura ?

We’re excited to welcome Kai Finance, the newest protocol building on top of Aura!

As a newer and unaudited protocol, we encourage everyone to DYOR and carefully assess the risks. Kai is designed to enhance rewards for $AURA voters through the introduction of $KAI and $kaiAURA tokens.

Users can deposit $AURA to receive $kaiAURA, which represents vlAURA in Kai. $kaiAURA can be staked to earn a boosted yield, currently offering an impressive 2x rate (117% APR). This amplified yield is possible because not all $kaiAURA is staked.

Keep in mind that converting $AURA to $kaiAURA is irreversible. While secondary markets exist, liquidity remains limited.

Additionally, users can stake Balancer Pool Tokens (BPTs) to earn rewards from:

✅ Trading fees

✅ $BAL incentives

✅ $AURA incentives

✅ $KAI incentives

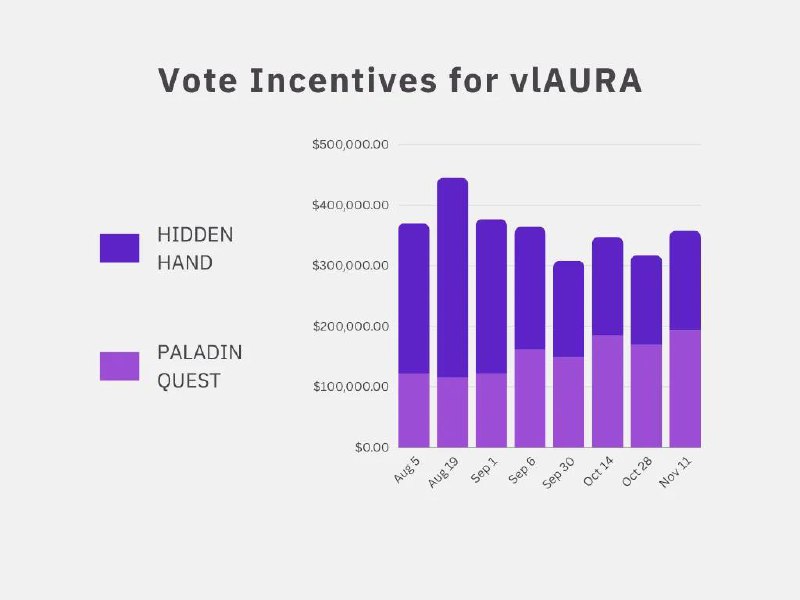

Over $350k has been distributed to vlAURA voters in the latest bi-weekly epoch.

Through @HiddenHandFi and @Paladin_vote, vlAURA voters are paid to direct incentives in the @Balancer ecosystem.

With vlAURA now deployed on Base, Mainnet gas fees aren’t an issue.

In October, the auraBAL Compounder bought $240,954 worth of auraBAL.

Utilizing its dominant 67% share of veBAL voting power, Aura can provide boosted rewards to @Balancer LPs. Fees get converted to auraBAL and staked in the Compounder.

Currently, auraBAL yields 24.3% vAPY.

DeFi Renaissance (real) inevitably leads to DeFi Wars.

How long until everyone realizes their tokens are going to need a lot more liquidity over the coming years?

Forward thinking protocols like @aave, @GnosisDAO, @AlchemixFi, and @TheTNetwork have already been accumulating.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 3 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago