Tren Finance

Borrow trenUSD. Leverage up to 30x using over 100+ tokens.

Community Channel: @chattrenfinance

Proposals: @ZekkoTren

📈 All the latest updates on the Stock Market: signals, news, and everything that might move the narrative — all in one place.

😉 We keep an eye on the price; you can just watch us do it.

Buy Ads: @JamesCookTg

Last updated 2 weeks ago

The official Yescoin™

Probably something.

Play🕹️: @realyescoinbot

Player support: @yescoincare

Business: @advertize_support

Last updated 1 month, 2 weeks ago

Fast transfers & trading, send meme gifts 🎁 and earn 100x returns — fun and flexible crypto app!

Incubated & invested by Binance Labs

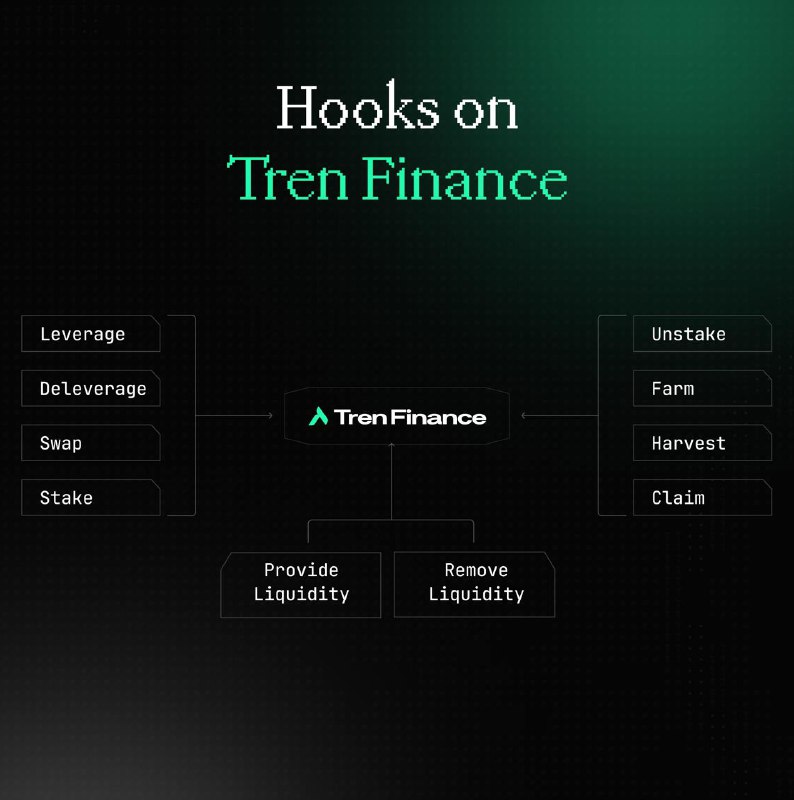

Introducing Hooks - customizable smart contracts that revolutionize how you interact with your assets.

Traditional money markets don't accept LP tokens as collateral, leaving billions in idle liquidity. With Hooks, you can finally use your LP tokens as collateral while still earning rewards.

Hooks automatically:

- Compound your yields

- Reinject rewards back into your position

- Manage your positions

and much more...

From simple token staking to complex yield optimization algorithms to one click leverage, Hooks represent the next evolution in DeFi capital efficiency. The future of programmable money markets is here.

Join us this Friday for our first ever community call in Telegram! We'll be sharing updates on what we've been building + some alpha you won't want to miss.

🗓️ Friday, December 6th

⏰ 1PM UTC

📍 Telegram

Haven't joined our TG yet? Join here

XY is the synthetic dollar debt token powering the Tren Finance ecosystem. Built using LayerZero's OFT standard, XY will move seamlessly across chains without wrapping or middlechains.

Features:- Overcollateralized by crypto assets

- No redemption mechanism

- Built-in peg stability mechanisms

Learn more about XY in our docs

Need a testnet code? We got you covered. First come, first serve:

I6G4M

I0U3G

Q4P7X

U3D7W

Q9Z8M

Access now: https://testnet.tren.finance/

testnet.tren.finance

TrenFinance

TrenFinance – TrenFi – is the DeFi Application based on Tren Finance.

📈 All the latest updates on the Stock Market: signals, news, and everything that might move the narrative — all in one place.

😉 We keep an eye on the price; you can just watch us do it.

Buy Ads: @JamesCookTg

Last updated 2 weeks ago

The official Yescoin™

Probably something.

Play🕹️: @realyescoinbot

Player support: @yescoincare

Business: @advertize_support

Last updated 1 month, 2 weeks ago

Fast transfers & trading, send meme gifts 🎁 and earn 100x returns — fun and flexible crypto app!

Incubated & invested by Binance Labs