V3V Ventures lounge

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

Excited to announce that V3V Ventures will be a Token2049 Dubai Platinum Sponsor this year!

Now that our workflow with the Singaporean custodian is finally in place, we can finally start sponsoring the events we love. 🫰

Our team hasn’t missed a single event in Dubai or SG for years, and we know this one is going to be special!

Can’t wait to meet the best builders in crypto and our fellow VCs!

Our first investments have started to bear fruit—a few recently had their TGEs, and their tokens are now trading on exchanges.

It’s worth noting that VCs typically receive tokens with a lock-up period of 1–2 years, gradually unlocking over time. This means even impressive returns of 5x–500x remain paper profit until fully unlocked. 😅

On the other hand, some tokens launch below expectations. However, with thorough due diligence, and general believe in the project, going long can be a smart play!

Take CrossCurve as an example: When it launched on exchanges, the price barely moved—our investment simply broke even, even with locked tokens. Yet, based on our research, we saw strong potential for a price surge. A leveraged long position—say, 5x on $100k—could’ve turned into $1M+ in profits.

So why didn’t we do it? The process of handling LP funds is quite structured. Our LPs acquire crypto via a licensed Singapore OTC desk and store it with a custodian. While transferring funds directly to startups has been streamlined, short-term trading on centralized exchanges (CEXs) requires a separate legal framework, which we’re still working to establish.

Adapting for such opportunities is a priority—we’re considering hiring a Singapore-based team member to handle real-time trading tasks.

Some time ago, we talked about Loop, a leveraged ETH restaking protocol – and now they’re live. We recently had a nice chat with the founder, who mentioned that allocating ETH to the protocol could generate nearly 50% real returns in ETH, including potential airdrop rewards, with the TGE expected in 2–4 months. It’s a promising opportunity for VCs to earn additional returns while supporting a project we’ve already backed.

So, we asked our custodian to deposit $500k into the protocol. It wasn’t a seamless process, but as they say, the first pancake is always a bit messy. 😄 Gonna share an update in a couple of months on how much ETH this move earns us!

P.S. None of the above should be considered as investment advice.

I haven’t written in a while – it’s been a busy time. During a bull market, everything looks shiny, but it takes time to evaluate opportunities and uncover the real gems.

Honestly, I’d probably lose my mind without such an incredible team:

- Serge – V3V co-founder and my long-time friend, who’s been amazing at keeping everything structured and running smoothly from the start.

- Stan – An ex-scientist and engineer with a PhD in Engineering from the University of Cambridge, bringing us top-notch deep tech expertise.

- James – Our portfolio manager, managing relationships with portfolio companies and partner funds, handling announcements, and overseeing deal flow.

- Anton – A senior analyst and due diligence digger, exceptional at spotting weaknesses in “future unicorns.”

- Dan and Ilya – Our junior analysts, who’ve been doing great at building initial connections with founders.

- And me – doing all this venture stuff together with Serge ?

Our recent deals include:

- Levr.bet – A sports betting platform leveraging DeFi on Monad.

- DeSyn – A decentralized restaking platform offering curated low/medium-risk options alongside potential airdrops.

- Primex – A leveraged trading and yield farming app enabling users to amplify positions using lender liquidity on DeFi protocols.

- Nomad Fulcrum – A convenient platform for selecting crypto and related investments.

- OrdeeZ – A Bitcoin liquidity protocol that unlocks BTC’s potential by enabling users to borrow, leverage, and earn passive yields, or buy premium Ordinals with just 20% upfront securely built on Bitcoin L1.

- Sunrise – A DA layer designed to meet the high data demands of L2 apps, particularly in blockchain gaming and AI projects.

I couldn’t fit everything into this post, I’ll share more updates soon!

Continuing from my previous post about Singapore, I want to share something not directly related to investments or crypto, but more rooted in ideology.

I entered the crypto space at its inception and still consider myself largely a Bitcoin maximalist. It’s fascinating to watch how the community has evolved, starting as an underground movement and now going mainstream on Wall Street. Looking at the people I met at Token2049, they’re clearly very different from those early meetups back in 2013, where people wore t-shirts with slogans like “Fuck the government.”

It got me thinking — have we abandoned the ideals of crypto-anarchism?

After all, this community was born from the cypherpunk movement, whose mailing list was where Satoshi first announced Bitcoin. They were the early adopters, and without them, crypto likely wouldn’t exist as it does today.

Timothy May’s manifesto predicted the creation of dark markets protected by cryptographic technologies, and we all know how that played out. Governments, with their strict AML/KYC regulations, now oversee and control the flow of cryptocurrency transactions. It’s like the famous saying: “If you can’t beat them, control them.”

If crypto was originally designed to free people from government control, now we’re seeing the rise of CBDCs (Central Bank Digital Currencies), which, in many ways, feel like the illegitimate offspring of crypto and the state, taking the worst aspects of both. With CBDCs, governments can decide when, how, and how much people can spend, effectively tracking every individual’s behavior with alarming precision. This level of surveillance could lead to deep intrusions into personal privacy, almost like a dystopian system—reminiscent of China’s social credit system. Step out of line, and you might not be allowed on a plane, or even into Disneyland.

But it’s not all doom and gloom. Shortly after Token2049, the Network State conference was held in Singapore. The idea is compelling: in essence, people can unite based on shared values and beliefs, rather than geographic location, and start building a new kind of “networked state.” Gradually and peacefully, these communities aim to replace outdated governmental institutions. Of course, they’ll need a physical hub to organize—and they’ve already found one: a beautifully ghost city in Malaysia, where these guys are starting to gather and get things moving.

As I’m writing this, the Network State idea reminds me of “Nomad Capitalist”—go where you’re treated best. But the Network State concept goes even further. Their plan is to create a meritocracy based on libertarian principles.

It’s definitely something to keep an eye on.

I'm writing a brief note on EigenLayer. This won't be a deep dive or an economic analysis, but rather my personal take on the project, especially since our LPs have acquired a significant amount of EIGEN tokens. We've also analyzed one of the AVSs (currently raising a round) that is responsible for transaction validation.

All AVSs on EigenLayer operate using a Shared ETH model.

Essentially, users deposit ETH with an operator, and the operator distributes it among the AVSs. Most operators are working with more than five AVSs. This introduces a significant slashing risk.

In my opinion, sooner or later, one of these AVSs will make a mistake, get hacked, or face some other issue, as the risk level is orders of magnitude higher than with native staking. And considering many users are also using liquid ETH the situation gets even messier.

There's a lack of incentive to hold EIGEN tokens. From what I see, a lot of tokens are being dumped on exchanges. Who's buying them back? Perhaps EigenLayer itself.

Apart from the airdropped EIGEN tokens, the AVSs themselves generate minimal profit (practically none), because there aren't any projects that are eager to "host" on EigenLayer. Why? Mainly because there’s no need for it, and every project prefers having its own token issued on an L1 like Ethereum or Solana.

Will this change in the future? I think that's a big "if."

Since there aren't any projects paying AVSs for “hosting” on EigenLayer, AVSs are now planning to issue their own tokens to raise funds (at insane valuations).

But who needs these useless AVS tokens? That's unclear.

I’m not here to predict the price of EIGEN or the fate of the entire EigenLayer ecosystem. But from what I’ve seen internally, there just aren’t any economic incentives to participate in the network (aside from the airdropped EIGEN). And there are no projects that really need EigenLayer at this point, for all the reasons mentioned above.

That said, crypto is unpredictable, and the famous VCs backing this project might just help it grow into something significant.

It's funny how things can go. I planned to catch up with @roxman for coffee, but in the end, we got caught by the Spanish police instead? Shit happens, but you gotta roll with it. While the police were busy checking Roxman’s expired driver’s license, we had time to hash out some ideas about collaboration between our ventures on Telegram.

I can definitely say that Roxman is a young, talented man with a bright future ahead, and I know I’ve gotta help him get there.

Just a few days later, V3V invested almost half a million dollars into @major to make that synergy happen. It’s not just about making a good deal—it’s about moving in the right direction?

Hola Amigos!

The last few weeks I’ve been spending time in the Caribbean region. First, I came to the great Bitcoin nation of El Salvador. Initially, it was supposed to be a short business trip to organize smooth communication between our LPs and local financial institutions. On top of that, I wanted to check out a few promising investment projects.

But, as things often go, plans changed. Instead of two days, I’m now on my third week here, all thanks to various bureaucratic procedures and whatnot.

While waiting for everything to get sorted out, I decided to explore what else I could do and figured, why not improve my health with some biohacking? I remembered that in the nearby Bahamas, there’s a branch of Cellcolabs, a Swedish startup that’s conducting clinical research on stem cells. I booked a quick call with them, and we agreed I could come ASAP. Luckily, my loved ones were close by in Canada, so I gathered everyone together, and we had a blast there. Of course, I also had an IV stem cell injection - 200 million MSCs in total, to be precise.

Back in El Salvador, I thought my business was finally wrapped up, but no - one more week of waiting! What to do now? Initially, I was hesitant, but boredom (and Bryan’s example) gave me the push I needed. So, I flew to Roatán, Honduras, and got minicircle.io ’s Follistatin gene therapy. Sounds kind of wild, right? But after COVID vaccines, nothing really fazes me anymore. Also, the island is really nice—I’m enjoying myself here, working remotely, admiring the beautiful coral reef, eating fresh food, and, well, sunsets are nice. ?

So, now I guess I’m officially a biohacker! Let’s see how this all works out. I’ll keep you updated.

Tomorrow I’m heading back to El Salvador to finally finish everything, and the day after, I’m hopping on a plane to Singapore for Token2049.

For me, Singapore isn’t just some gleaming, high-tech Disneyland. I actually spent two years there, building my network and gaining valuable experience. This time, I’ll be there for a week with lots of meetings lined up with founders, and I’m excited to catch up with some old friends too. Seems like everyone’s going to be there!

We recently closed the deal with Bracket.fi (a platform for Staked Liquid DeFi), along with a few other projects:

• Shieldeum.net - a Web3 cybersecurity solution for 440 million crypto users, powered by an AI-driven decentralized physical infrastructure network (DePIN).

• Brkt.gg is leading a new wave in prediction markets, focusing on innovation, transparency, and strengthening BRKT’s role in DeFi.

We’ve also made a few deals that will remain private for now, but I’ll probably post about them later.

Finally, we’ve partnered with Movement Labs to help Bitlayer become the most popular L2 on Bitcoin.

See you later, guys!

I have a few updates to share:

• Deal with U2U Network - Done.

• Bracket - in the last stage.

• Finally, we are working on an investment in Ghostdrive: The #1 Telegram Drive - https://t.me/ghostdrive_bot as it said: “Easy to use, upload files, and directly integrated with the Filecoin network.”

Recently, a lot of different games have become very popular on Telegram. One of those games is Hamster Combat, which gained over 250 million users in just a few months. When I saw this, I was really curious about how they managed to grow so quickly, and the answer, as always, lies on the surface - Freebies, Sir.

Users click, tap, play, and receive in-game currency, hoping that one day this currency will become the new Ethereum. Funny story - I recently took a taxi, and the driver was playing Hamster while driving, seriously telling me how he plans to buy a country house with the tokens he has earned. There are many people like this - they want to believe in a miracle, that there is some magic money button that will help them get rich quick.

Let's do some elementary school math: averaging a $50 giveaway to each user totals $12.5 billion. But $50 is not enough to motivate anyone.

If we average it to $500, we will get a cosmic sum of $125 billion, which exceeds the GDP of many countries.

Another question/consideration is that, unlike other cryptocurrencies, where users bring value to the network, Hamster’s users only want to make a profit, and the token giveaway will lead to its immediate sell-off and, consequently, a deep fall.

I recently heard from an acquaintance that Hamster’s owners plan to sell the users through a listing on some little-known exchange where, to get their tokens, users will need to trade on the exchange and perform some other actions. It sounds like the online casino model - everything has already been invented before us ?

Speaking of clickers, in the course of my activities I have contacted many people and even worked together with some of them on some things ? One of them is Roxman, the creator of the @major project.

Recently, we collaborated on promoting our news and education resources in @major, so more people will subscribe to our channels. Here, I'll list them:

@venture - Insights on global startups and investment trends.

@trading - Essential trading tips, strategies, and market analysis.

@startups - Curated SaaS app ideas and useful entrepreneurial resources.

@ether - Latest cryptocurrency news, trends, and expert insights.

Let's make the Telegram ecosystem stronger and people smarter.

Just a few days ago we successfully invested in crosscurve.fi, now we are working on deals with U2U Network and also Bracket which is building a platform for Staked Liquid DeFi.

I used to be a good reverse engineer, so let's try to do something similar with older crypto projects.

By considering the market as a system where many hidden forces interact with each other, we can find patterns and make assumptions based on available data to extrapolate into the future, even without insider information.

In the last 2 years, many cool and promising projects have been created in the cryptocurrency industry. Most projects have already received VC funding and already have their own token, which is traded on various exchanges. Since many founders overestimate their new projects and there are many interesting old projects, some of which have tokens trading at their all-time low, the question arises: is it possible to choose promising old projects and buy the token through an exchange to achieve 5-10x returns in a few months?

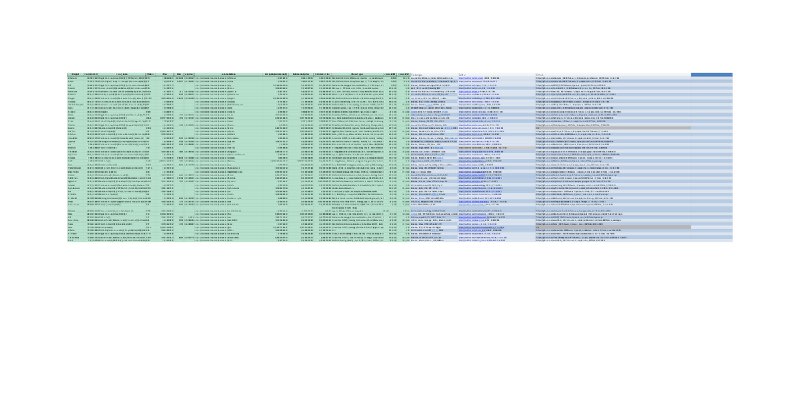

To do this we selected all projects that started in the last 2-3 years and created an excel sheet where we indicated: VC price (the price at which VC funds entered), Start price (the initial trading price), and Price now (the current price). Then we calculated the ROI for retail investors and the ROI for venture investors. We categorized the projects by industry. We made a selection of venture funds (with their tier) that invested in the projects. We added the exchanges on which the token is currently traded. We analyzed each projects' presence on social media and how actively they have continued project development (GitHub).

Additionally, one can check through Arkham or Messari, or manually, how many tokens the venture funds still hold.

This table is not a ready-made list for investment - it’s just some interesting research materials for making informed decisions based on your own preferences.

Using this method, we can also search for the hidden logic behind market movements. For example, one can ask: which funds have historically worked with "money makers" to pump tokens? Having their vesting period ending they can do a good pump. Another common indicator for a pump is a listing on major exchanges (e.g., Binance), so we should find funds that helped their projects to do such listings and extrapolate to other projects they backed, but haven’t listed yet. There are many other direct and indirect guesses that can be made using the table. For sure you should pay special attention to projects’ social media and GitHub.

In other words, to make the table work we need to find the data that is not currently factored into the project's price, and by modeling the future, buy the token at its lows. It is particularly interesting because the entire market is falling now, and the tokens of many projects are at rock bottom - the best time to buy!

Here is the table https://docs.google.com/spreadsheets/d/14k-H6lK8y2XhXfURI640kCB0SzSjRZ39JYiISPwH5Rs/

Sorry guys, I was away for a bit as moving to Barcelona took lots of time and effort. However, it was worth it and I’m enjoying my summer here with a great mix of parties and nature nearby.

Let’s come back to our work. Despite being summer, it is a pretty busy time for venture deals.

Recently we invested in BitLayer - a Layer 2 blockchain based on Bitcoin with BitVM that supports smart contracts.

It seems fancy to make an L2 staking solution on Bitcoin, so let’s see how it goes.

++Founders - technical lead at Huobi and head of business development at Tezos and Polygon.

++For the public round (July) they want to reach a valuation of $1 billion?♀️

The second project we invested in were two NFT farming games onewayblock.com and clasofcoins.com I liked their strong founders with relevant experience. It’s riskier than BitLayer but could be way more profitable for us.

We are in the final stage with:

U2U network - that wants to build L1 blockchain with its own blackjack and crypto farmers.

CrossCurve - curve.fi aggregator bringing multiple blockchains into a single, global market

++Michael Egorov, founder of Curve Finance in partnership with eywa.fi

++Using curve.fi infrastructure and liquidity

++cross-chain listings and increased yield generation and low slippage

Unfortunately I can’t speak about deals that we have declined to participate in.

We found red flags with those deals, but it’s very tricky to discuss publicly as it could be harmful for their reputation, and you never know – I could be wrong.

Overall, I think most founders overvalue their projects nowadays, but a bear market should help them to see things more clearly.

By the way, over the past 2 years, many cool and strong projects have been created, and at the moment their tokens are at the bottom. In my opinion this is a great time to buy. (I am not giving financial advice in any form.)

I carried out a large analysis on many criteria and in the near future I will post the table exclusively in this channel.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago