Ibtido Fund

Asoschi: Abbosbek Turabidinov

Eng ishonchli AKKAUNT SAVDO ??

Xalolik foydadan ustun ✅

‼️ Eslatma: Kanalimizga Joylanayotgan Akkauntlarning Barchasi Turnirda Yutilgan!

✅ADMIN - @CARDINAL_AKKAUNT_ADMIN

Last updated 2 years, 1 month ago

QASHQADARYO24 - Қашқадарё вилоятида энг тезкор янгиликлар ва видеолар етказиб берувчи биринчи рақамли каналга хуш келибсиз!

? https://Qashqadaryo24.uz

⚡Реклама хизмат: @QashqadaryoReklama_admin

? Хабар юбориш: @zoirovs

Last updated 1 year, 1 month ago

Bizni kanalda pubg akkauntingizni sotishingiz yoki sotib olishingiz mumkin??

Reklama Narxi 19,000 so'm✅

??Reklama uchun: @Cardinal_Admin

?Garant uchun: @cardinal_admin

? UC Uchun: @cardinal_uc

☎️Tel: +998906666646

?Reklama oraliq vaqti 20 minut

Last updated 1 year, 2 months ago

Portfolio Optimisation: Tashkent Stock Exchange

Investors prefer gaining maximum degree of expected return in their portfolio by holding a minimum level of risk (volatility of portfolio). In 1952, Harry Markowitz proposed a solution to optimise the portfolio through relations of expected mean and variance of stocks. Markowitz proposition was to build a portfolio of securities with optimal weights which might generate maximum level of return for a given level of risk. Three factors: expected return, variance of stocks and covariance matrix are primary constituents of optimal portfolio composition as claimed by Markowitz. Aside of naïve strategy which is based of constructing portfolio with equal weights, optimal portfolio allocates weights into stocks in the way that stocks with higher expected return with minimum volatility will be assigned higher weights than those stocks with lower expected return with higher volatility. The data used for optimisation is collected by historical prices of securities and thus, it is assumed that optimisation process holds estimation errors.

I have been doing my master’s thesis on the topic of estimating the efficiency level of portfolio optimisation amongst securities within S&P500 and planning to compare the efficiency of optimisation over naïve allocation. So, I believe it would be interesting to observe how stocks that are trading in Tashkent Stock Exchange might be compared with optimal composition. To construct the portfolio of securities, I have selected the following stocks which are considered more volatile and traded with higher volumes.

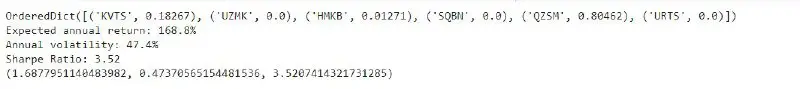

Stock tickers: $KVTS $UZMK $HMKB $SQBN $QZSM $URTS

To accelarate the optimisation problem, I have employed Python to calculate portfolio return, variance, covariance and optimisation process automatically in a few minutes. The data for all 7 stocks are taken from 1 year of historical price movement. Results show that investor who aim to purchase Uzbek stocks and plan to construct optimal portfolio, aimed at generating maximum level of return with minimum risk level should allocate 80.46% of its deposit into $QZSM stocks, while the rest 18.26% of the fund should be used to buy $KVTS stocks and the only 1.3% weights should be forwarded to $HMKB stocks. The below graph shows the expected annual return and volatility if portfolio weights are allocated accordingly.

Disclaimer: This information should be used for educational purposes only and it should not be regarded as financial advice to contruct the portfolio with the same allocations.

Why correlation is important in investing into stocks?

A central component of modern portfolio theory is not limited to analysis of volatility and expected returns of stocks, but the correlation degree between stocks also plays a key role in building optimized portfolios that have exposure to unsystematic risks.

Correlation implies the degree of co-movement between two stocks over time. If ABC stock has the performance of upward movement in the last 2 weeks, while DBA stock is also performing positively with 5-10% of the increase in price, both stocks are claimed to have a positive correlation degree.

Correlation degrees range from -1 (perfectly negative) to 1 (perfectly positive), while 0 degrees or any level close to 0 is said to have zero correlation. The intention to beat the market promotes portfolio managers to build optimized correlation matrices that possess correlation degrees of less than 0.2-0.3 levels among all variables.

At the same time, individuals can reduce their exposure to individual asset risk by holding a diversified portfolio of assets, while this diversification can be checked by correlation degree between two stocks. However, some portfolio managers oppose the idea of the usefulness of correlation due to its dynamic behavior and continuous fluctuations by nature.

Likewise, several research papers confirmed the fact that correlation generally rises during the market turbulence and international diversification benefits decrease when they are most needed.

If any ‘Ibtido Fund’ followers have built their portfolio of stocks without considering the level of correlation, I kindly suggest you to use the following website service that offers you real-time correlation degree levels between your assets.

The website link: https://www.portfoliovisualizer.com/asset-correlations

Today, I tried to build a bit of a diversified portfolio of stocks among 5 industry group members. Here is the list of industries and stocks associated with them:

Apparel Retail - $CHS

Auto Manufacturers - $LI

Consumer Electronics - $HEAR

Grocery Stores - $SFM

Medical devices - $CUTR

At the same time, using the service mentioned above, the correlation matrix between stocks is presented below. As you can notice, stocks have less degree of correlation and it is one of the foundations of building a diversified portfolio that reduces unsystematic risk and protects the portfolio during market rotations.

Portfoliovisualizer

Asset Correlations

Calculate and view correlations for stocks, ETFs and mutual funds

Stocksuz kanal kuzatuvchilari uchun maxsus uzoq muddat uchun saralangan aksiyalar to'plami.

Ushbu aksiyalardan portfel tuzgan xolda, mavjud depozitingizni 10% qismidan 10ta aksiyaga diversifikatsiya usulidan foydalanib sarmoya kiritishingiz mumkin.

Quyidagi Top 10 aksiyalar ro'yxati (tikerlari asosida):

$HIMS

$RMO

$CAN

$SINO

$TYHT

$FF

$OCGN

$NNDM

$QTT

$RIDE

Ushbu aksiyalarga sarmoya muddati 3 oydan 6 oyni tashkil etadi.

Ushbu aksiyalar ketma ketligidan foydalanib Python dasturi orqali optimal ko'rinishdagi portfel yaratish orqali ushbu natijaga erishdik:

Machine Learning natijalariga ko'ra ehtimoliy 221% yillik daromad topish uchun bu ketma ketlikda sarmoya qilishingiz kerak:

CAN aksiyalariga 8% depozitingizni;

TYHT aksiyalariga 5% ulushingizni;

FF aksiyalariga 32% ulushingizni;

OCGN aksiyalariga 42% ulushingizni;

NNDM aksiyalariga 11% depozit ulushingizni yo'naltirsangiz ehtimoliy daromadingiz 221% yillik tashkil etadi.

Natijalar algoritm orqali taqdim etildi, moliyaviy maslahat sifatida qabul qilmang.

Sarmoya kiritishni rejalashtirsangiz, avvalambor, o'zingiz fundamental tahlil qilishga harakat qiling, ammo yuqoridagi aksiyalar kelgusida kuchli o'sishga erishadi.

Eng ishonchli AKKAUNT SAVDO ??

Xalolik foydadan ustun ✅

‼️ Eslatma: Kanalimizga Joylanayotgan Akkauntlarning Barchasi Turnirda Yutilgan!

✅ADMIN - @CARDINAL_AKKAUNT_ADMIN

Last updated 2 years, 1 month ago

QASHQADARYO24 - Қашқадарё вилоятида энг тезкор янгиликлар ва видеолар етказиб берувчи биринчи рақамли каналга хуш келибсиз!

? https://Qashqadaryo24.uz

⚡Реклама хизмат: @QashqadaryoReklama_admin

? Хабар юбориш: @zoirovs

Last updated 1 year, 1 month ago

Bizni kanalda pubg akkauntingizni sotishingiz yoki sotib olishingiz mumkin??

Reklama Narxi 19,000 so'm✅

??Reklama uchun: @Cardinal_Admin

?Garant uchun: @cardinal_admin

? UC Uchun: @cardinal_uc

☎️Tel: +998906666646

?Reklama oraliq vaqti 20 minut

Last updated 1 year, 2 months ago