CRYPTO LION TRADING CHANNEL 🦁📈🏆

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 10 months, 3 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 1 week ago

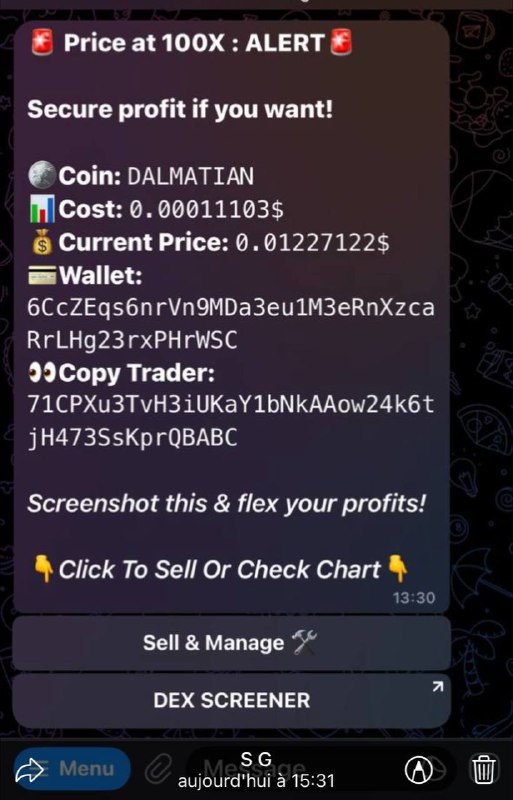

*🚨 This wallet did 20X : ALERT🚨***

Join this trading bot and check ur favorite wallet to copy!👇

https://t.me/Mirror_autobot?start=542710805

Channel

https://t.me/Mirrorbot_announcements

Join us @eljadegen

Best Card so far i have seen for crypto users.

Kyc in seconds and u can use ur card immediately and pay.

Wow this is freaking amazing

First 100x for one of my followers using the copy trading ?

Try it now fam ?

https://t.me/Mirror_autobot?start=542710805

After u deposit use this channel and find ur favorite wallet to copy

Start your Copy trading on chain

Use the bot and deposit ur $Sol and start to copy.

https://t.me/Mirror_autobot?start=542710805

Join @eljadegen

Check the channel and search your favorite wallet to copy ?

https://t.me/Mirrorbot_announcements

We mentioned in previous posts the we were buying in the 61/58k range in anticipation of the liquidity impulse for October. We are lightening up our position a little in this level but remain LONG. The market is moving up on Trump odds widening as well as liquidity expansion that we mentioned. We are watching the meme space actively as well and will post some insights on this going forward.

NFP came out 254k with unemployment rate at 4.1%. Market is moving on the on 254k headline number but be cautious as the unemployment number negates it somewhat.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 10 months, 3 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 1 week ago