Saral tax india

📈 All the latest updates on the Stock Market: signals, news, and everything that might move the narrative — all in one place.

😉 We keep an eye on the price; you can just watch us do it.

Buy Ads: @JamesCookTg

Last updated 1 month ago

The official Yescoin™

Probably something.

Play🕹️: @realyescoinbot

Player support: @yescoincare

Business: @advertize_support

Last updated 2 months, 1 week ago

Fast transfers & trading, send meme gifts 🎁 and earn 100x returns — fun and flexible crypto app!

Incubated & invested by Binance Labs

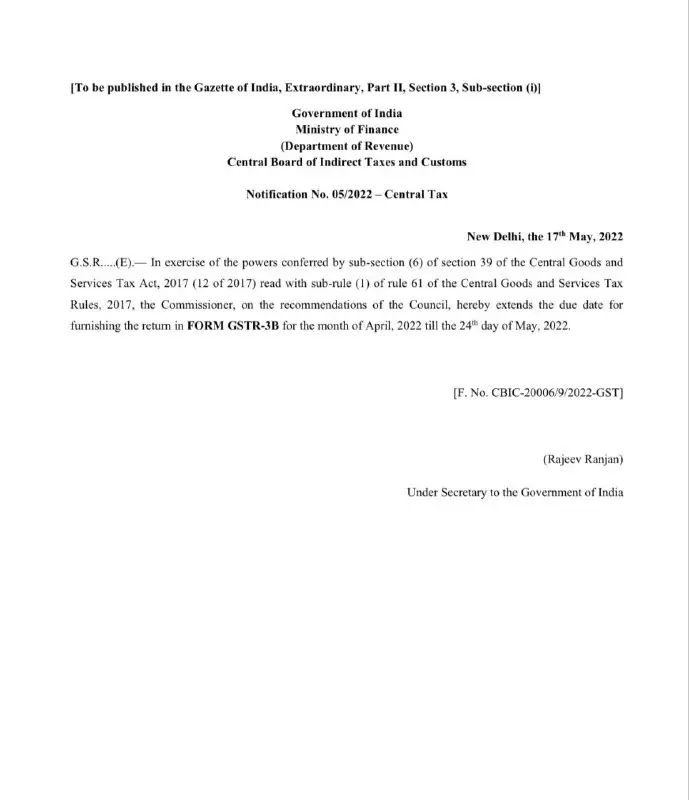

The due date for filing FORM GSTR-3B for the month of April, 2022 has been extended till 24th May, 2022 (refer notification No. 05/2022-Central Tax dated 17.05.2022).

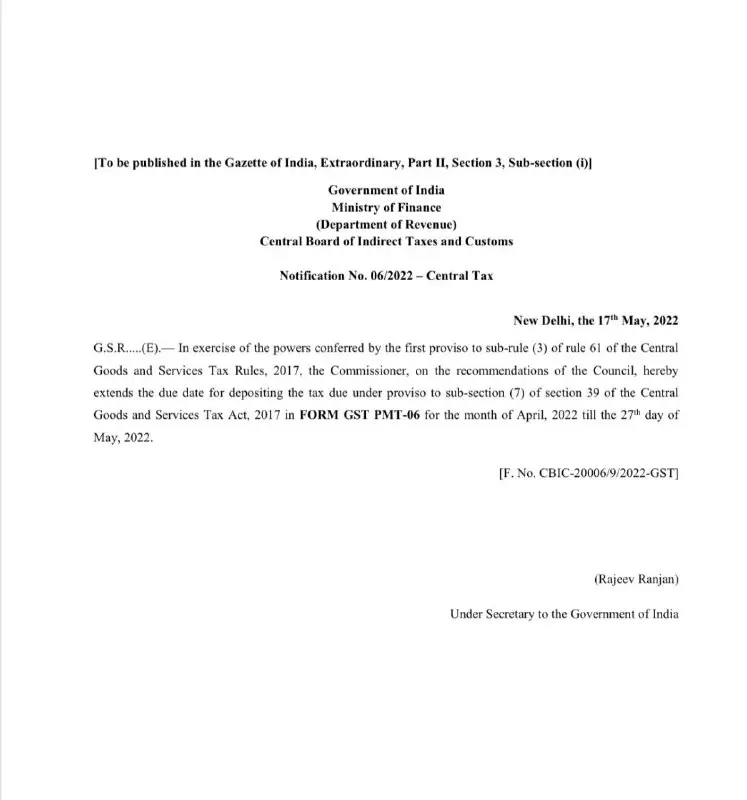

The due date of payment of tax for the month of April, 2022 by taxpayers under QRMP scheme in FORM GST PMT-06 has been extended till 27th May, 2022 (refer notification No. 06/2022-Central Tax dated 17.05.2022)

Tally Prime Shortcut Keys

https://www.saraltaxindia.com/2022/04/tally-prime-shortcut-keys.html

Saral Tax India | सरल टैक्स इंडिया

Tally Prime Shortcut Keys

Tally Prime Shortcut Keys, Full list of shortcut keys that work on tally prime, tally prime shortcut keys list, tally prime shortcut keys full list,

नवरात्रि स्थापना की शुभकामनाएं ??

माँ दुर्गा भक्तो का करती विघ्न विनाश...

भक्तो की पीड़ा हरे, माँ करती कल्याण...

हिंदू नव वर्ष की आप सभी को हार्दिक शुभकामनाएं...

यह वर्ष खुशियों से भरा मंगलमय हो आप सभी के लिये ऐसी ईश्वर से प्रार्थना करते हैं...!!!??

तिवारीजी के यहाँ बेटा पैदा हुआ है नाम रखा....

GST ....गौरी शंकर तिवारी ?

बड़े होने पर लोग कहेंगे...

SGST....श्री गौरी शंकर तिवारी ?

उनके शादी के Invitation Card पर उनका नाम छपेगा....

CGST....चिरंजीवी गौरी शंकर तिवारी?

ओर जब विदेश जायेंगे तो वहाँ?

IGST (इंडिया के गौरी शंकर तिवारी)?

इस खूबसूरत मुस्कान के साथ पुराने वित्तीय वर्ष की happy ending और नए वित्तीय वर्ष की शुभकामनाएं .

Section 234H fee for not linking PAN with aadhar

https://www.saraltaxindia.com/2022/03/section-234h-fee-for-not-linking-pan.html

Saral Tax India | सरल टैक्स इंडिया

Section 234H fee for not linking PAN with aadhar

PAN is required to link with Aadhaar on the IT Portal on or before 31.03.2022, after that fee of Rs 500 till 3 month after that Fee of Rs 1000.

What is E-Invoicing under GST, w.e.f. 01-04-2022

https://www.saraltaxindia.com/2022/03/what-is-e-invoicing-under-gst.html

Saral Tax India | सरल टैक्स इंडिया

What is E-Invoicing under GST, w.e.f. 01-04-2022

An e-invoice is a Tax Invoice that is normally issued by every registered taxpayer but it contains some additional information in the form of a QR Cod

Link PAN with Aadhar till 31 March 2022. Plz check your status below link if you have done ignore it.

? Here are two useful links for you:

Click here to check the status of your PAN – Aadhaar linkage:

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

? Click here to link your Aadhaar with PAN.

https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

📈 All the latest updates on the Stock Market: signals, news, and everything that might move the narrative — all in one place.

😉 We keep an eye on the price; you can just watch us do it.

Buy Ads: @JamesCookTg

Last updated 1 month ago

The official Yescoin™

Probably something.

Play🕹️: @realyescoinbot

Player support: @yescoincare

Business: @advertize_support

Last updated 2 months, 1 week ago

Fast transfers & trading, send meme gifts 🎁 and earn 100x returns — fun and flexible crypto app!

Incubated & invested by Binance Labs