DT PRIME

Here, we openly discuss positioning for trades/investments.

Join @DissidentThoughts, contact @phdugh

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

gross $840 billion …](/media/attachments/dis/dissidentthoughtsprime/152.jpg)

GS Research estimates gross $840 billion corporate buybacks in 2024, 4% more than in 2023 which was a top 3/4 year for corporate buybacks... This may help mute weakness specifically in the largest tech stocks throughout the year.

market reaction …](/media/attachments/dis/dissidentthoughtsprime/151.jpg)

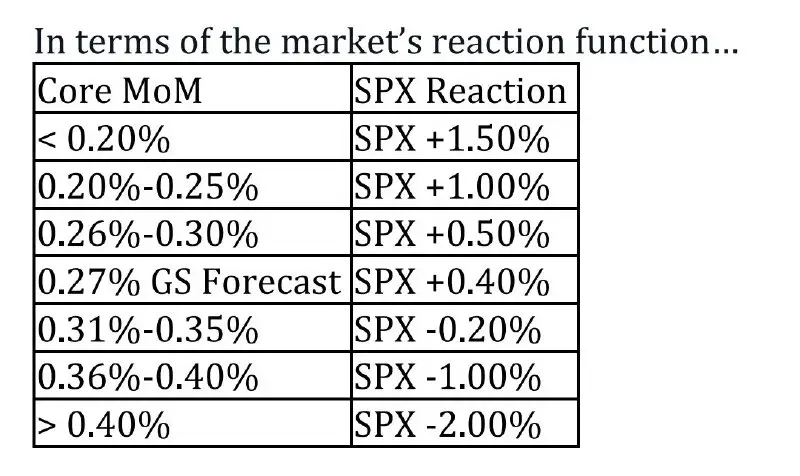

And quickly, here's JPM's market reaction matrix for the CPI in a half hour:

Note that these are headline MoM figures, not core MoM. Headline has tended to print lower than core recently, but the two are close and markets are paying attention to MoM prints. 0.2% and below and stocks run with it.

As for what the options market is telling, today's straddle is pricing about a 1.0% move.

We're back with the options course. Remind me to never again begin a project three days before Christmas.

In case you feel overwhelmed by the sheer volume of posts (I left it at 12 for today), just understand that I am proceeding at a snail's pace and that none of the content on @DTPrimers is going anywhere. Here's a table of contents, which is continuously updated, if you want to move between sections.

Thanks for the support and the kind words.

Also if you have any comments re: the options course, feel free to ask in these comments or in the Dissident Thoughts chat.

Telegram

DT Primers

THE OPTIONS COURSE (Will edit this list as the posts get out there). - Intro - Options Basics - Premium, Intrinsic Value, and Moneyness - Extrinsic Value: Time & Volatility - Risk Profile - Long call example - Options Valuation - The Greeks - Directional…

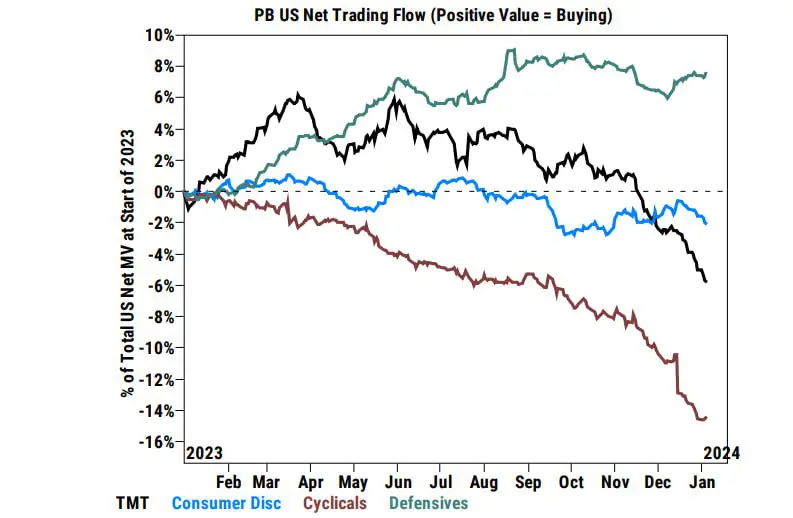

Note that the Trading Flow chart shown above does not describe net positioning, but instead the change* in positioning over the last year. However, the divergence between cyclicals and defensives is still significant.

The Pain Trade of 2024

Hedge funds are very clearly betting on recession in 2024. This is not suggested by just one side of a pair trade taken on by funds doing L/S, but by their net positioning flows over the last several months and recent double-downing into energy shorts.

The Cyclical/Defensive pair trade is the recession trade: Defensives (Consumer Staples, Health Care, and Utilities) will tend to outpeform Cyclicals (Energy, Materials, Industrials, Financials, and Real Estate) during economic malaise, or at least perform less worse. At least in theory.

Thus, in anticipation of recession, one might short cyclicals and buy defensives. Based on trade flows, this is what funds appear to be positioning for. Absent recession, this trade falls apart as the shorts (cyclicals) outperform the longs (defensives).

This dynamic creates one giant Pain Trade for 2024, and it is no landing (no recession). We don't expect a U.S. recession in 2024 — an election year. The Treasury will run inane deficits to put it off further.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

is set to be more …](/media/attachments/dis/dissidentthoughtsprime/157.jpg)