Binance Research

https://research.binance.com/

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

The U.S. Fed recently started cutting interest rates, for the first time since 2020. The crypto market is up ~56% since then.

Our latest #Binance research report dives into the Fed, rates, major economic indicators, and asset performance.

Read on ⬇️

https://www.binance.com/en/research/analysis/the-fed-interest-rates-and-the-economy-a-primer

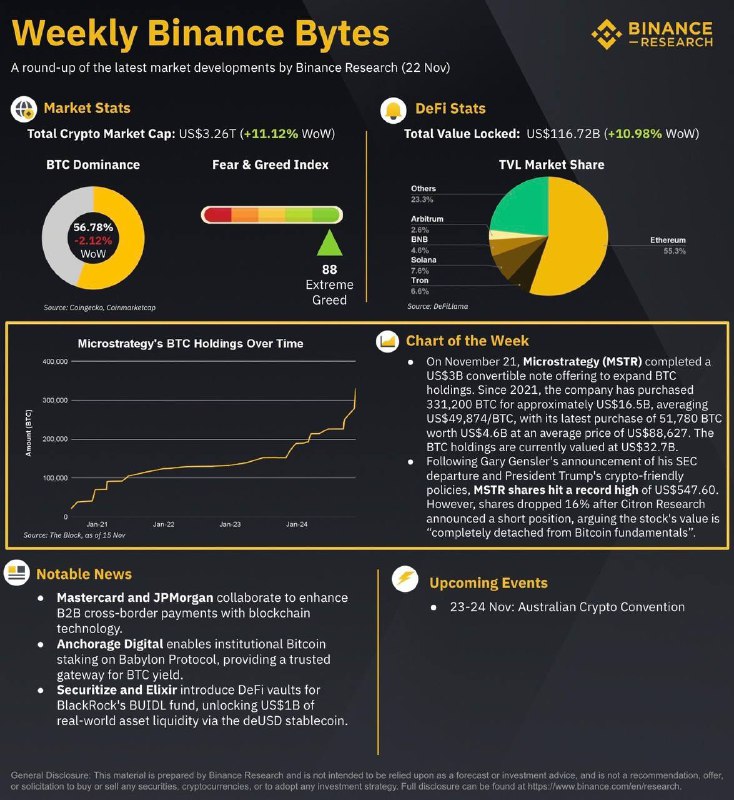

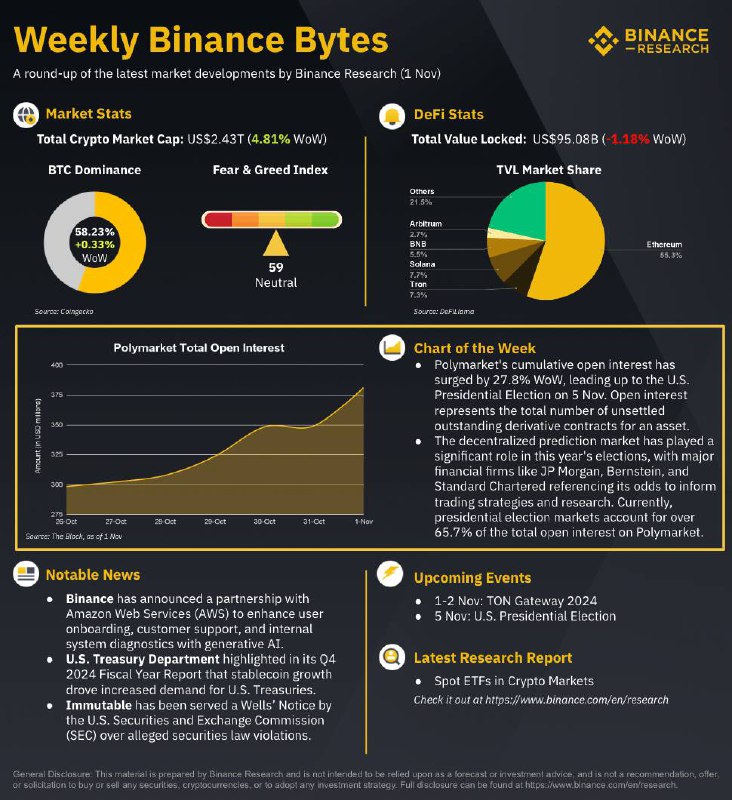

Happy Friday! Binance Bytes is an initiative by the Research team to provide a quick round-up of the week.

Highlights ?:

1/ Mastercard's Multi-Token Network (MTN) has partnered with JPMorgan's Kinexys Digital Payments to improve B2B cross-border payments by offering greater transparency and faster settlement. This integration allows mutual customers to settle transactions through a single API, enhancing the efficiency of digital global commerce.

2/ Anchorage Digital has announced support for Bitcoin staking on the Babylon protocol, allowing institutions to participate in staking as Babylon expands its capacity with the Cap-3 launch.

3/ Securitize and Elixir have launched DeFi vaults for BlackRock's tokenized money fund, BUIDL, allowing holders to earn interest from U.S. Treasury bills while accessing DeFi opportunities. This development unlocks significant liquidity, allowing BUIDL holders to mint sBUIDL tokens and participate in DeFi while continuing to earn underlying yields.

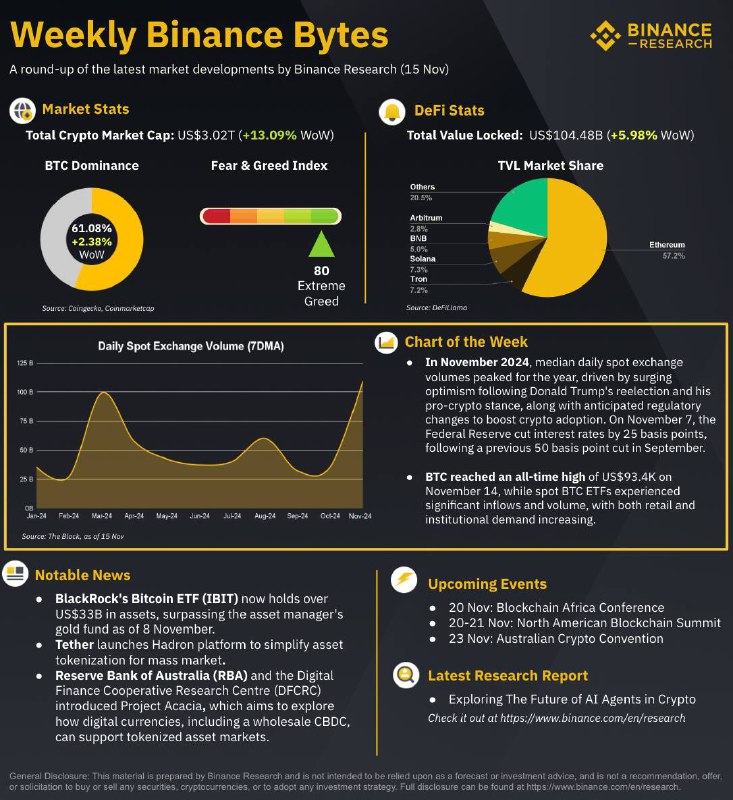

Highlights ?:

1/ BlackRock's iShares Bitcoin Trust (IBIT) ETF now holds over US$33B in assets, surpassing the asset manager's long-standing gold ETF, iShares Gold Trust (IAU). This milestone is remarkable given that IBIT was launched only 10 months ago, compared to IAU which has been trading since 2005. The surge in assets follows a significant inflow of US$1.1B on November 7, driven by investor optimism after Donald Trump's presidential election victory.

2/ On November 14, 2024, Tether announced the launch of Hadron, a platform designed to simplify the tokenization of various assets, including stocks, bonds, stablecoins, and loyalty points.The platform supports multiple blockchains and provides a user-friendly interface, enabling institutions, fund managers, governments, and private companies to easily tokenize and manage assets.

3/ The Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) released a consultation paper for Project Acacia, seeking industry feedback on the use of digital money and infrastructure to support wholesale tokenised asset markets in Australia.

Could AI agents become the next big players in crypto markets?

Our latest #Binance research report dives into the convergence between AI agents and crypto, discussing its origins, major projects, challenges, and future implications.

Check it out ⬇️

https://www.binance.com/en/research/analysis/exploring-the-future-of-ai-agents-in-crypto

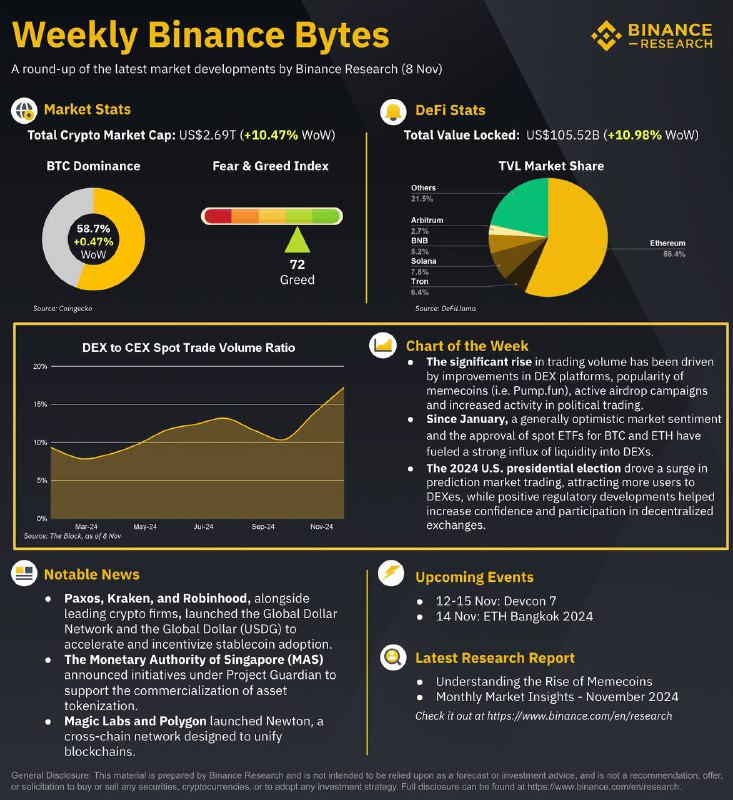

1/ Robinhood, Paxos, Anchorage Digital, among others, have launched the Global Dollar Network to drive adoption of a new stablecoin, USDG. Issued by Paxos in Singapore, USDG complies with the Monetary Authority of Singapore's (“MAS”) upcoming stablecoin framework. The network aims to distribute income from USDG’s reserves among partners, as distinct from majors like USDT and USDC.

2/ The MAS announced plans to advance tokenization in financial services, focusing on creating commercial networks, developing market infrastructure, fostering industry frameworks, and enabling shared settlement facilities. MAS also launched the Global Layer One (“GL1”) initiative for cross-border digital infrastructure and published industry frameworks for tokenized fixed income and funds.

3/ Magic Labs and Polygon have launched Newton, a cross-chain network designed to make using dApps across multiple blockchains seamless. Built on Polygon’s AggLayer, Newton lets developers build dApps that work across different chains without requiring users to manage multiple wallets. Magic Labs will also integrate its chain-agnostic crypto wallet, Passport, into Newton.

Time to look at November's market insights!

Discover the current market landscape and key insights on:

? BTC & S&P500 Correlation

? Application Revenues

? New Token Launches

? Memecoins Growth

…and more.

Read here ⬇️

https://www.binance.com/en/research/analysis/monthly-market-insights-2024-11

In case you missed it:

- Donald Trump is returning to the White House (Inauguration is in Jan 2025).

- The Republicans look likely to control both the Senate and the House.

- Overall, these give the Republicans powerful leverage in policy making (e.g., tax/fiscal spending).

Here's how the markets have reacted:

- Crypto market is on fire: BTC hit a new ATH, with altcoins and memecoins rallying. Trump's win is seen by many as positive for crypto. Remember, he also has crypto exposure through his NFT collections and World Liberty Financial (DeFi).

- Equity markets are up: Stock futures are positive, with S&P 500 on track for a potential record high. Trump's plans for deregulation, tax cuts and increased government spending is expected to stimulate the economy. Though, look out for higher tariffs.

- Higher treasury yields/long-term interest rates: 10-year yields have surged to 4.5%, a six-month high, driven by expectations that Trump's agenda could drive inflation higher (here we go again).

- Stronger U.S. dollar: At risk of over simplification, higher inflation = higher interest rates = stronger dollar.

- China stocks/Yuan feeling the impact: The yuan declined 1% v.s. USD, marking its largest decline in over a year. China H-shares tumbled, with the Hang Seng China Enterprises Index (HSCEI) down around 2.6% today.

What's next:

- Short-term: Expect more volatility in the coming days. Markets have the tendency to whipsaw. Liquidations may cause huge moves in the market.

- Medium-term: More fiscal spending, lower taxes, supportive regulations (hopefully) bode well for crypto.

- Others: Fed's FOMC meeting happens on Thursday. Markets still expect a 0.25% rate cut, which aligns with our view. However, we expect the number of rate cuts ahead to be fewer than initially expected, especially if inflation picks up with increased spending.

Highlights ?:

1/ Binance has announced a partnership with Amazon Web Services (“AWS”) to leverage its generative AI capabilities for improving user onboarding, customer support, and internal system diagnostics. This collaboration has already led to significant improvements and Binance plans to further expand the use of AWS's generative AI technologies across various operational domains to drive innovation.

2/ The U.S. Treasury Department highlighted in its Q4 2024 Fiscal Year Report that stablecoin growth drove increased demand for U.S. Treasuries, estimating that US$120B of stablecoin collateral is invested in Treasuries. Tether, the largest stablecoin issuer, reportedly holds US$81 billion in T-bills.

3/ The U.S. Securities and Exchange Commission (“SEC”) has issued a Wells notice to blockchain gaming platform Immutable, signaling potential enforcement action. The notice allegedly concerns the listing and private sales of the platform's native IMX token in 2021. Immutable has vowed to contest the notice, arguing that the SEC's allegations are unfounded.

…](/media/attachments/bin/binanceresearch/722.jpg)

In under a year, spot #Bitcoin ETFs have drawn US$18.9B+ in net inflows, now holding US$63.3B, making them the third-largest segment of BTC holders.

Our latest #Binance research dives deeper into how these ETFs are shaping crypto markets.

Check it out ⬇️

https://www.binance.com/en/research/analysis/spot-etfs-in-crypto-markets

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago