Yurta

Twitter: @frontiervalueh1

Email: [email protected]

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 12 months ago

"Uranium prices have fallen just over 5% YTD from $91/lb to $86/lb today, having peaked at $107/lb in February.

Those who have been in the uranium trade for several years will understand the inherent volatility associated with the underlying uranium price and relevant equities.

Taking the Sprott Uranium Miners ETF (URNM) as a sectoral benchmark, we have seen multiple periods of weak performance since 2020:

-February 2020 - March 2020 = -32%

-June 2021 - August 2021 = -28%

-November 2021 - January 2022 = -40%

-April 2022 - June 2022 = -37%

-September 2022 = -22%

-January 2023 - March 2023 = -19%

-February 2024 - March 2024 = -21%

-May 2024 - Today = -12%

During this period, URNM shares have appreciated >300% despite 8 separate double digit pullbacks.

While the uranium thesis has undoubtably come a long way since 2020, we believe the current pullback in prices has put various uranium names on temporary sale, and expect the sector to recover as it typically does within the next few weeks.

Spot price weakness has been the result of some unexpected lbs hitting the market albeit not in quantities that should worry investors. At the same time, the long-term contract price continues to rise, trading at $78/lb at the end of last month. The term price is asserting itself as the more accurate reflection of the uranium market, as this represents real utility demand and is not subject to shorter-term trader and financial speculator volatility. One prominent trader we spoke with recently said they have never seen the term market this busy, despite topline volumes being down YTD, once again highlighting the opacity of the uranium market.

When referring to a supply side response in the uranium market, it is often easy to forget that supply does not only have to come from uranium producers, but can also find its way to the market from these financial speculators and traders who have either met price targets, or have quarterly performance deadlines. Given the higher price environment in which the sector now operates, we are seeing an increasing presence of these market participants looking to capitalise on the inherent volatility of the sector."

I won't share the actual report as it's a subscription service, but my friends over at Ocean Wall have done first class analysis of the uranium market. Here is a piece of copy from todays note.

Uranium is a volatile industry. One needs to have a stomach for the volatility and the right postion sizing to have it not bother them. While spot is choppy, the trend remains from the lower left to upper right and amid this whiplash, uranium equities are equally volatile, but their outperformancr versus the broader market since 2020 has been nothing short of impressive.

Knowing what one owns and why they own it is important.

Travel plans:

I'm in Istanbul 12-16 June

Thereafter, Tbilisi Georgia for 2 weeks.

If anyone is around and keen for a coffee or beer, you can ping me on Telegram @adventureinvestor

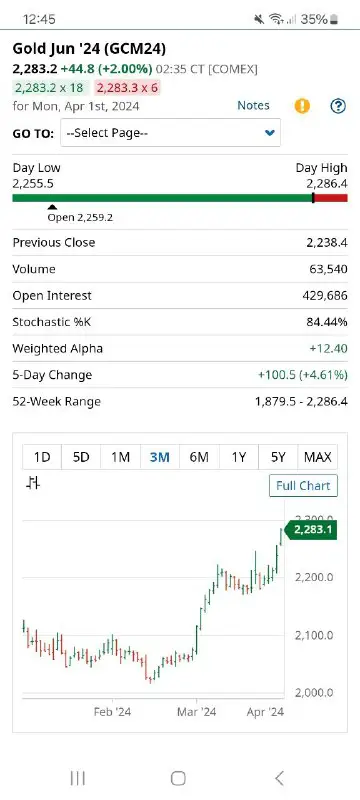

Gold ripping after a record high monthly close. Feels like...

It's amazing gold is >$2,240 and miners haven't woken up yet. Many still down >50% from 2022

That's a juicy upgrade in resource. The coup in Niger last summer was a gift. https://finance.yahoo.com/news/global-atomic-updates-dasa-project-120000465.html

I was on a call yesterday with some new friends and got asked about uranium among other things. The trade has been a wonderful one, but the easy money in a less volatile environment is over.

Interestingly no one is asking me about cannabis (which I discussed on a commodity podcast with Jesse Day of "Commodity Culture", highlighting cannabis as the most misunderstood and attractive commodity) in November which makes me excited as it's in a stealth bull market, very much under the radar of the masses.

Rumors this week of some news potentially coming out of the White House soon. Regardless of whether that happens or not the stocks are cheap, under owned and moving higher while the majority are either negative or could care less. Bullish!

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 12 months ago