Paradigm Edge

Only on @tradeparadigm

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 1 week ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 4 weeks ago

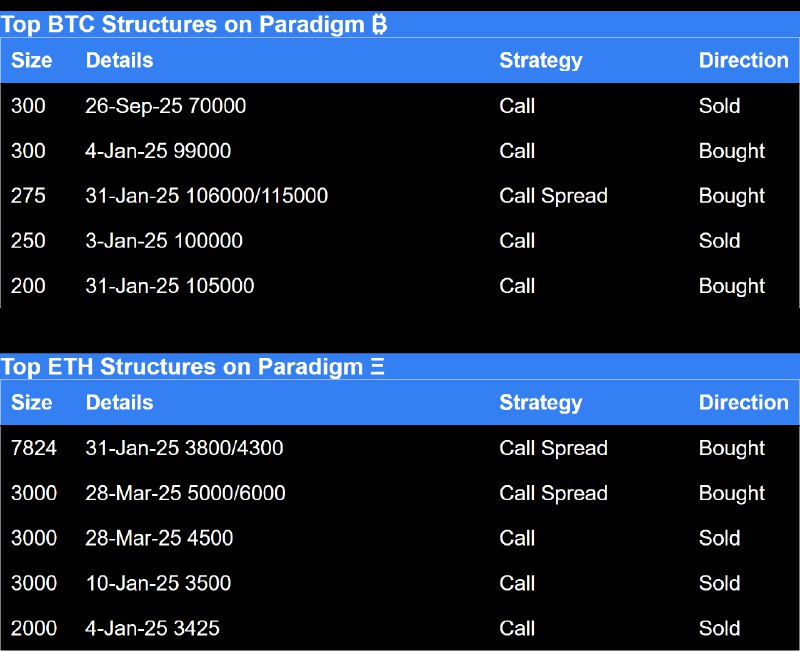

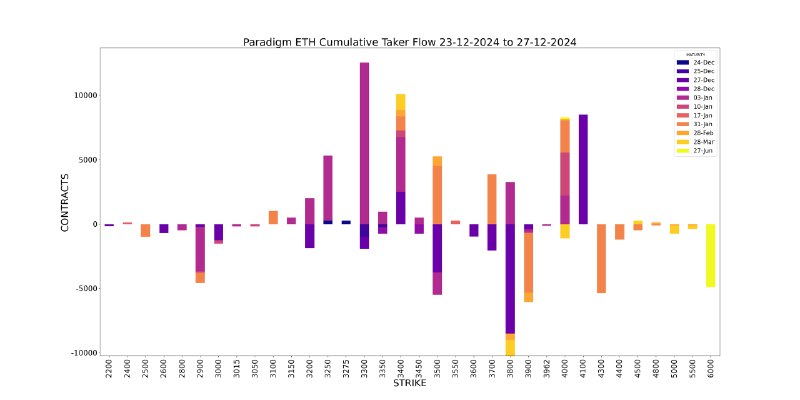

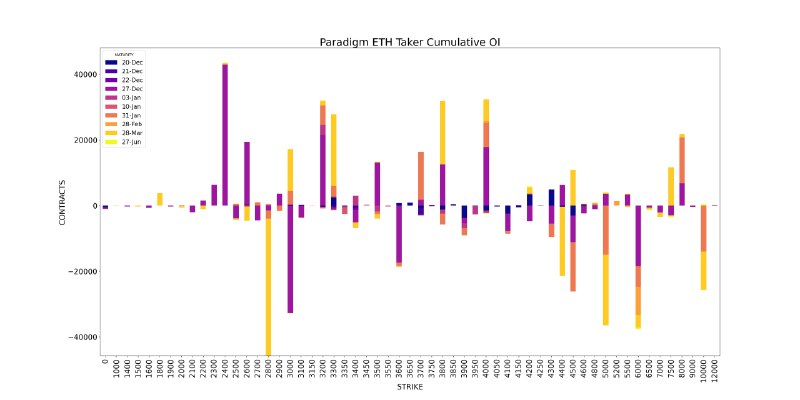

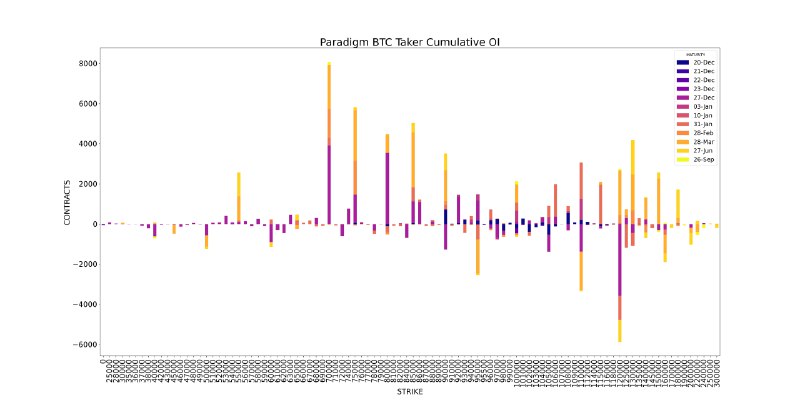

Paradigm Session Recap - January 2, 2025

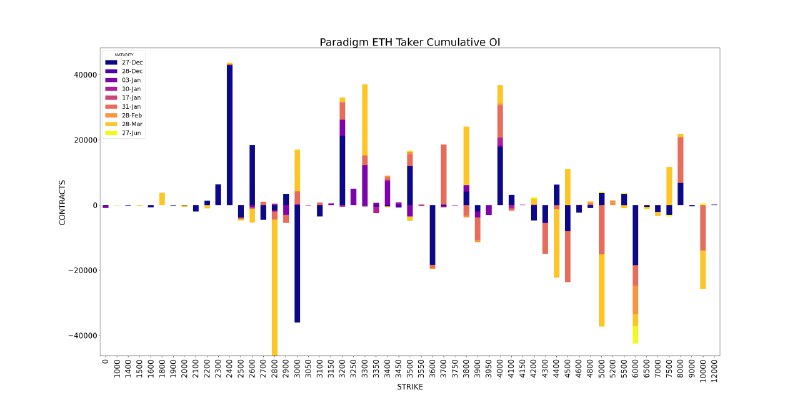

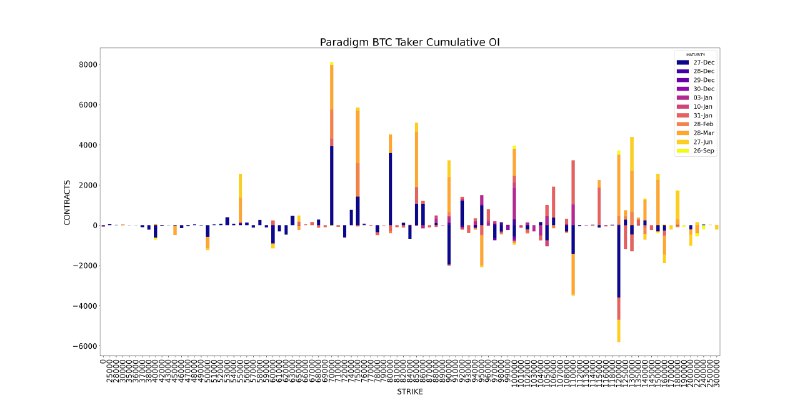

Both BTC and ETH term structures remain in contango. BTC fronts are around 52v and backs near 62v, while ETH fronts sit at 62v and backs at 72v. BTC basis now hovers around 15% annualized. BTC flows were mixed, with ITM calls sold. ETH upside was lifted through OTM call spreads.

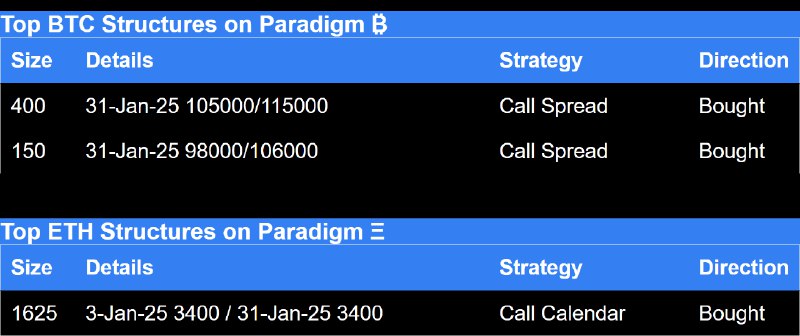

Paradigm Session Recap - December 30, 2024

A slow session saw upside lifted through OTM call spreads. We want to thank everyone for 2024's milestones. Wishing y'all a prosperous and rewarding New Year.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 1 week ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 4 weeks ago