📊 Cryptonomy

Stay safe with authentic information.

Support: @cryptonomy_support

Twitter(X): x.com/cryptonomy_fi

https://cryptonomy.finance

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

A Chinese tech giant has started accepting BTC payments.

One of the leading microchip manufacturers, Nano Labs, has begun accepting Bitcoin as a payment method.

Following this announcement, the company’s shares on Nasdaq rose by nearly 3%.

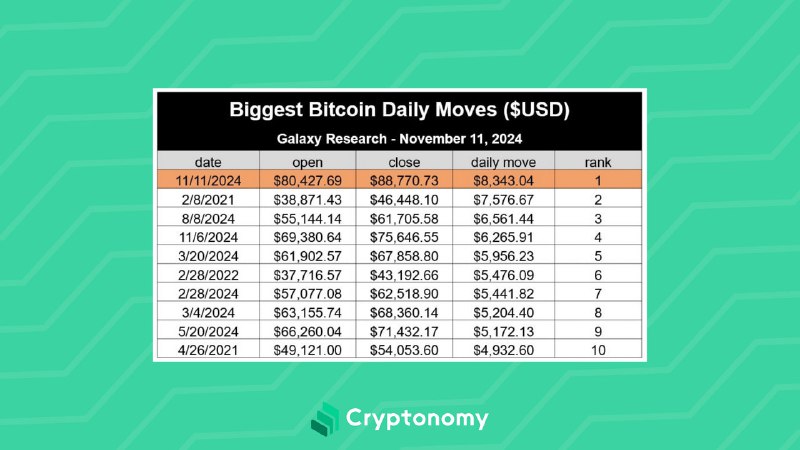

⚡️ On November 11, Bitcoin recorded its largest single-day increase in history — up by $8,343.

*?*Cryptocurrency Market / Fear and Greed Index for 12.11

? BTC ≈$88 600 (+8.90%)

2️⃣ ETH ≈$3 340 (+5.30%)

• Market Cap ≈$3T (+9.68%)

• Fear & Greed Index: Extreme Greed

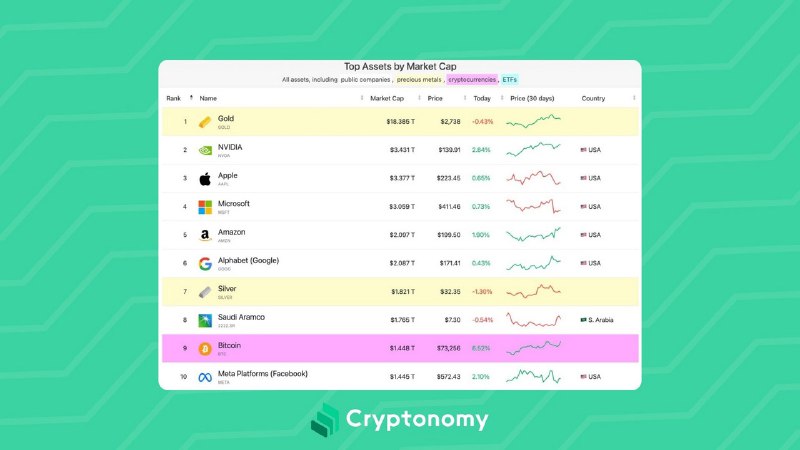

Bitcoin has surpassed Meta, securing the ninth position among the world's largest assets by market capitalization.

Apart from Bitcoin reaching a new all-time high, almost the entire altcoin market is also showing growth.

⚡️ Bitcoin hits a new all-time high, trading above $75,000 amid Trump’s likely victory in the presidential election.

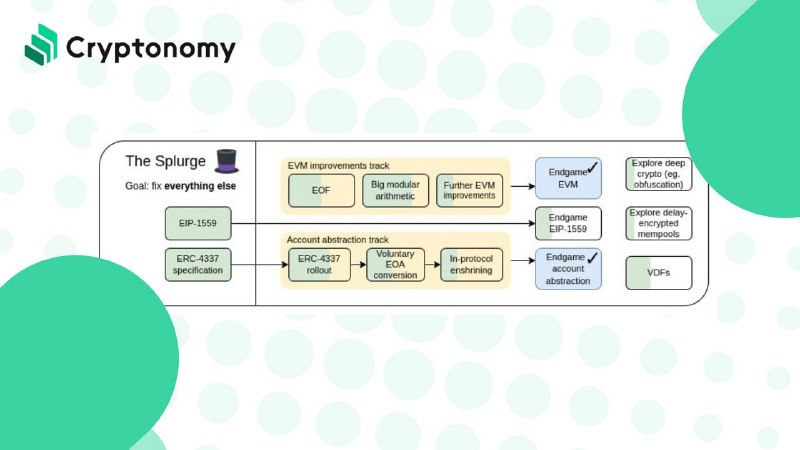

The Splurge: Buterin Shares Details on the Final Phase of Ethereum’s Roadmap

Ethereum founder Vitalik Buterin has outlined the goals for The Splurge, the concluding phase of Ethereum’s blockchain roadmap.

Key objectives of The Splurge:

? Bring the Ethereum Virtual Machine (EVM) to a complete and stable state.

? Implement account abstraction.

? Optimize transaction fee economics, increase network scalability, and reduce risks.

? Set a long-term development trajectory by leveraging advanced cryptographic solutions.

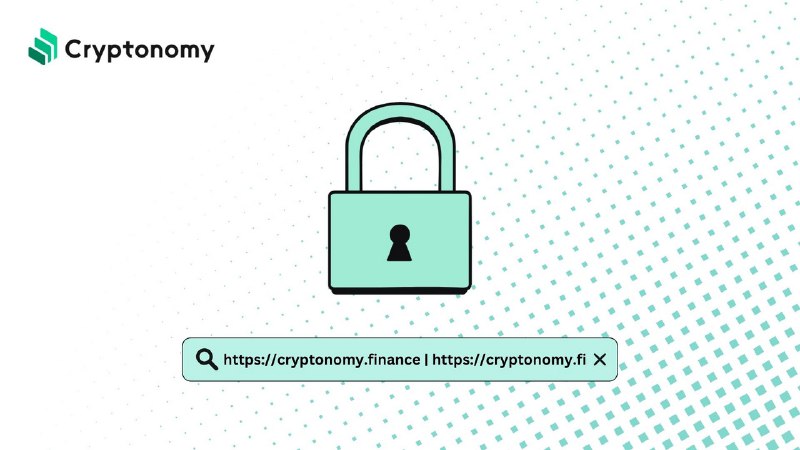

Important Notice:

Official access to our website is exclusively available at the following URLs: https://cryptonomy.finance and https://cryptonomy.fi.

Please note that we do not currently offer official applications for Android or iOS. To ensure your security, we strongly recommend using only the provided links and avoiding unofficial websites.

Thank you for your attention.

*?*Cryptocurrency Market / Fear and Greed Index for 30.10

? BTC ≈$72 400 (+2.12%)

2️⃣ ETH ≈$2 642 (+0.98%)

• Market Cap ≈$2.4T (+1.63%)

• Fear & Greed Index: Neutral

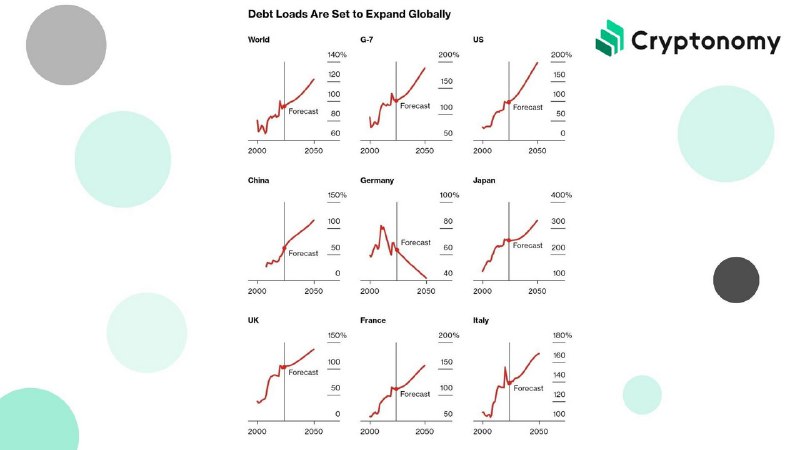

IMF: Global Government Debt to Reach New High in 2024

Our forecasts indicate an unrelenting combination of low growth and high debt – a challenging future ahead. Governments must work on reducing debt and rebuilding buffers for the next shock – which is inevitable and may come sooner than we expect.

In IMF terms: the world is on the brink of a new financial crisis, and current government actions are only worsening the situation.

The leading drivers of global government debt are China and the United States.

The IMF urges policymakers to reduce budget deficits through spending cuts and tax increases. However, authorities are hesitant to lose political support and seem inclined to delay the crisis for as long as possible, hoping to later shift the blame elsewhere.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago