⚫️ BLACK-BALLED ⚫️

👉🏼 BlackBallNewsletter.Substack.com 👈🏼

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

? BREAKING! Fauci ‘Could Be Indicted’ for Destruction of Records.

“Sen. Rand Paul, R-Ky., contends there are grounds to prosecute Dr. Anthony Fauci, the face of the COVID-19 pandemic in America, based on congressional testimony from a top aide to the longtime director of the National Institute of Allergy and Infectious Diseases…The most important knowledge that we learned is that [Dr.] David Morens, 20-year assistant to Fauci, was purposely evading FOIA, which is the law. More than that, he was also destroying evidence,”

“He was taking emails and destroying them,” Paul said of Morens. “When he was asked about it, he said he didn’t know emails were federal records. Nobody is that stupid.”

Fauci NEEDS to be indicted, prosecuted to the FULLEST extent of the law, and then put away FOR LIFE IN GITMO FOR CRIMES AGAINST HUMANITY.

That would be the ONLY acceptable outcome, but I won’t hold my breath…

This man has DESTROYED MILLIONS OF LIVES with his LIES…

https://www.dailysignal.com/2024/05/24/rand-paul-fauci-could-be-indicted-for-deleting-records/

US Tariffs

The United States announced a comprehensive list of tariffs that will be applied to goods from China. From 2024 to 2026, the tariffs will affect goods worth $14-18 billion:

- Tariffs on semiconductors will rise from 25% to 50%.

- Tariffs on batteries for electric vehicles will increase from 7.5% to 50%.

- From 2026, tariffs on ALL batteries will also increase to 50% (now think about which modern device does not use them).

- Tariffs on solar elements made from graphite will increase from 25% to 50%.

- Tariffs on steel and aluminum products will rise from 0-7.5% to 50%.

- Tariffs on electric vehicles will increase from 25% to 100%.

Summarizing, the U.S. stated that Chinese goods are "unfairly cheap." In layman's terms, this means "we can't compete, so don’t let Chinese goods reach anyone." Of course, they forgot to ask the opinion of ordinary Americans who will have to pay for all this.

Why You Should Be Investing in UAE Real Estate Before It’s Too Late ??

Substack

Why You Should Be Investing in UAE Real Estate Before It's Too Late

Unlocking Opportunities in the United Arab Emirates

*? PAY ATTENTION!!! ?***

It is NO coincidence that ALL of these ILLEGAL FIGHTING AGED MALE ALIENS are going to the coastal cities. NONE of them are going to the Midwest, or other “fly over” states.

That is because I think they are planning a “pincer” like ATTACK on the whole country starting from the coasts, then spreading in both directions inward toward the bulk of other states. That’s why I believe the coastal areas have the most “sanctuary cites”.

HOW do they know WHERE they are supposed to go already when they arrive here?!?

When asked, their response is either New York, Pennsylvania, or California. Mostly New York.

Ask your self…Do these seem like well intentioned, harmless people just looking for “a new life” in America??

WHERE are all of the women and children??

There was maybe 2 or 3 women in that whole mix.

America is headed towards a VERY detrimental RED DAWN type of scenario facilitated by the United Nations, and the Biden Regime.

BY DESIGN.

BE PREPARED FOR ANYTHING.

Biden Administration Pushing for "The Strictest" Restrictions on Vehicle Emissions in US history

The Environmental Protection Agency (EPA), according to US media reports, will update "green" industry standards limiting CO2 emissions from transportation this week. Currently, this sector is the largest source of climate pollution, accounting for about 20% of the US carbon footprint. The details of the new restrictions, which have not yet been disclosed, are expected by the EPA to radically change the US auto market.

To comply with the standards by 2032, the share of EVs in the sales of all new vehicles, including light-duty models (sedans, SUVs, pickups, etc.), must exceed 65%, compared to less than 10% in 2023 and 5.8% in 2022. Additionally, there will be a stricter formula for calculating the fuel economy standard for electric vehicles, non-compliance with which will result in heavy fines for automakers. Industry experts note that these norms contradict the existing Corporate Average Fuel Economy (CAFE) standards.

The authorities intend for this decision to significantly stimulate electric vehicle (EV) sales as part of the energy transition strategy and align with climate goals to reduce greenhouse gas emissions by half by 2030. Despite tax incentives of up to $7,500 offered to buyers last year for purchasing locally manufactured electric cars, the penetration rate of EVs in the US remains relatively low.

The US automotive industry is actively resisting the radical plans of the Biden administration. Major automakers, including Ford and GM, believe that the set targets are "neither reasonable nor achievable within the proposed timeframe" and do not consider external factors, such as the readiness of the charging station infrastructure and power supply. They emphasize that complying with the new standards will significantly increase vehicle costs while reducing the available model range, directly impacting American consumers' wallets. Even with government subsidies, the average cost of an electric vehicle is currently about $52.5 thousand compared to $24 thousand for popular compact models.

Private Equity Sector Experienced its Most Severe Downturn Since the Financial Crisis Last Year

According to Bain Capital's annual report, the direct investment market was essentially "paused" in 2023 due to the sharpest and most rapid interest rate hikes by Western central banks since the 1980s. This increase in financing costs undermined investor confidence in the industry, which had seen exponential growth in recent years. By the end of 2023, private equity funds had accumulated a record amount of unrealized assets totaling $3.2 trillion – a total of 28,000 unsold companies.

Global private equity deal volume fell 37% from 2022 – to $438 billion from $699 billion. Over the last two years, this indicator has decreased by 60%, while the number of transactions dropped by 35%, indicating a significant revaluation of previously inflated investment valuations of companies worldwide. The total value of businesses sold or listed on exchanges by PE funds in 2023 fell 44% year-over-year – to $345 billion, the lowest level in a decade. The practice of reselling companies between private funds, sometimes likened to a financial pyramid, also lost popularity — in value terms, the volume of such transactions crashed by 47%.

The slowdown in the sector poses challenges for funds seeking to sell illiquid assets and return funds to investors amid a drop in their own returns to levels seen during the global financial crisis. PE funds typically own assets for no more than 3-5 years, with the share of companies older than 4 years in the total volume already exceeding 45% – a record level since 2012. According to Bain analysts, to return investments, funds need to sell almost half of the accumulated assets over several years, while they have already begun to increase their debt load, taking loans under portfolios of assets. Last year, about $1.2 trillion was raised for buyout financing, marking the lowest since 2018. Despite steady economic growth in the US, with record-low unemployment and strong stock markets, Bain warns of growing macroeconomic uncertainty and persistent recession risks in the States. This combination of factors will be a long-term obstacle to market recovery.

Bain

Green shoots for private equity emerging after sector’s worst slump since the global financial crisis—Bain & Company Global PE…

Uptick in activity gives optimism over improving prospects as interest rates stabilize. But unprecedented challenges persist, with liquidity critical as exits logjam from $3.2 trillion in unsold assets blocks returns of capital to LPs

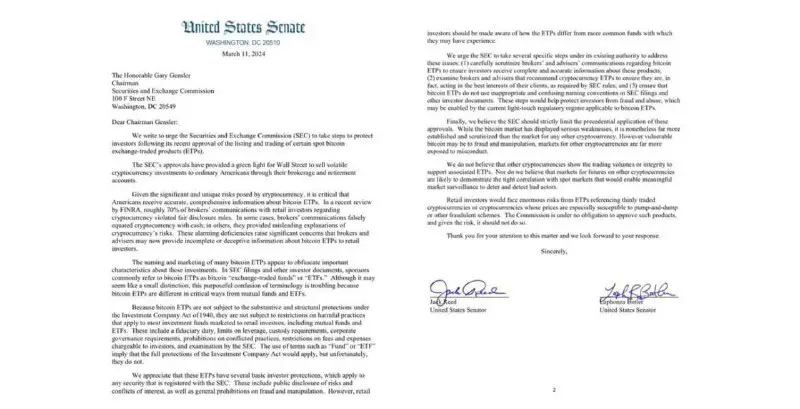

No more crypto ETFs?

Democratic senators are calling on the SEC not to approve ETFs for any other cryptocurrencies.

Previously, several analysts lowered the likelihood of spot ETH-ETFs being registered in May—from 70% to 30%. Bloomberg believes that the SEC will not approve them this year at all, citing stagnation and low engagement of the SEC in the negotiation process with issuers.

US Budget Deficit for 2024 Reached a Historic High of $828 Billion

This significantly exceeds the deficit in 2023 ($635 billion) and the previous record in 2021 ($763 billion).

The deficit in February amounted to $296 billion compared to $262 billion in Feb. '23, $217 billion in Feb. '22, and the standing record of $311 billion in Feb. '21. February always sees a deficit in the U.S., but this time, the spending has notably accelerated. Ongoing budget agreement processes have not impacted the rate of expenditure.

Excluding accounting manipulations with a $0.3 trillion advance for student loan write-offs that was never realized, the annual deficit gradually increases, reaching $2.1 trillion. There are no grounds to believe that the budget situation will improve, and here's why:

Expenditures increased by 9.2% for the fiscal year, or by $226 billion, reaching $2.68 trillion over 5 months, where:

1️⃣ Interest expenses increased by $116 billion compared to last year

2️⃣ Support for the banking system – $60 billion

3️⃣ Defense spending increased by $39 billion

These three items alone accounted for almost the entire increase in spending for the year, meaning stimulation and support of the economy haven't even started against a backdrop of a deficit exceeding $2 trillion. Thus, any extraordinary situation instantly "splits" the budget.

1️⃣ Social Security and veterans' support increased in expenditures by $69 billion over 5 months

2️⃣ Medical expenses grew by $40 billion.

These two categories will only grow due to demographics and inflation.

This was largely compensated by a reduction in direct grants and benefits (this category included "helicopter money" in 2020-2021) by $81 billion, but there's no more room for cuts, only room for growth.

In the structure of revenues, almost 85% are taxes and fees from individuals.

What does this mean? The structure of income and expenditures is highly vulnerable. Even the slightest hints of a recession (not to mention a crisis) will significantly increase the budget deficit to the background levels of $2-2.2 trillion, i.e., $4 or even $5 trillion are entirely plausible, but there's nowhere to get these funds from, implying the need for Quantitative easing.

And as we know, QE means something Yellen just apologized about - it starts with In, ends wit flation.

Nvidia Insider Tench Coxe Sells Stock

A recent company filing with the Securities and Exchange Commission (SEC) revealed that Director Tench Coxe offloaded 200,000 shares of the company for about $170 million. Coxe, a board member since 1993, acquired these shares for an unbelievable $0.82 in 1997, two years before the company went public. To put that into context, Nvidia's market cap back then was less than a billion dollars.

Up a staggering 112,911% since then, it would be an understatement to say that the third-largest shareholder of the company has made a tidy profit on his NVDA shares. Notably, after this sale, Coxe still owns a stake worth 0.1515% in the company.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago