ProtoCall (Official)

[ https://www.protocall.asia ]

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

Zhao Changpeng, founder of Binance, tweeted that the United Arab Emirates (UAE) holds $40 billion worth of Bitcoin. Binance is currently headquartered in Dubai, UAE. However, the source of the information is some unknown websites, and there is no official confirmation yet.

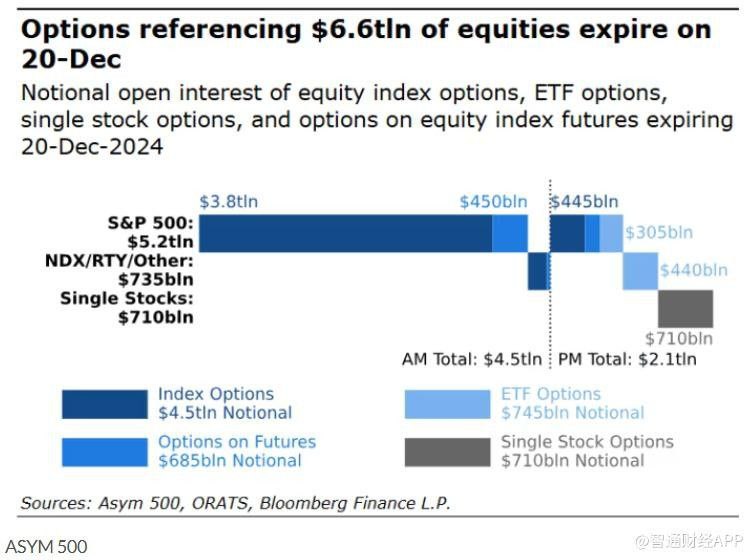

TODAY: A record $6.6 trillion in options will expire in the US stock market, potentially causing significant volatility that could impact the crypto market.

Alliance DAO partners said on the podcast that they hope that Bitcoin will not fall below 58,000 in the next four years. Because that is the liquidation price of MicroStrategy. If it does happen, it may trigger a crisis 100x bigger than Luna and FTX. The best case scenario is that Bitcoin rises to 500,000, which will make Saylor the richest person in history and the first trillionaire in human history.

Semler Scientific $SMLR has acquired 211 BTC for ~$21.5 million at ~$101,890 per #bitcoin and has generated BTC Yield of 67.0% QTD and 92.8% since adopting our BTC treasury strategy in May. As of 12/15/24, we held 2,084 $BTC acquired for ~$168.6 million at ~$80,916 per bitcoin.

?? Public Company Semler Scientific buys another 211 Bitcoin worth $21.5 million.

QCP Asia Colour – 16 December 24

Yet another milestone: BTC surged past 106,500 during early Asian hours. Short liquidations totaling approximately USD151 mm over the past 12 hours fueled the rally, as an illiquid and complacent weekend (Deribit funding briefly turned negative) market squeezed shorts on the topside.

The BTC/Gold ratio reached an all-time high during the move, amplifying Bitcoin’s status as “digital gold” and cementing its position as an increasingly favored store of value over traditional gold.

MicroStrategy’s inclusion in the Nasdaq 100 added further momentum to market sentiment, with Michael Saylor hinting at additional BTC purchases, even with spot prices above 100k. This inclusion could trigger passive fund inflows into MicroStrategy shares, indirectly enabling the company to raise funds more easily for acquiring Bitcoin.

This week’s central bank meetings seem to be mere background noise for crypto, with BTC remaining firmly sentiment-driven. While highly unlikely, an extremely dovish Fed and Powell could still provide the push Bitcoin needs to climb even higher.

Over $1.7B was liquidated today, pushing December’s total to more than $5.1B in liquidations!

Today was also nearly double the size of the August 4th liquidation cascade — unsurprising as the market heats up and volatility increases.

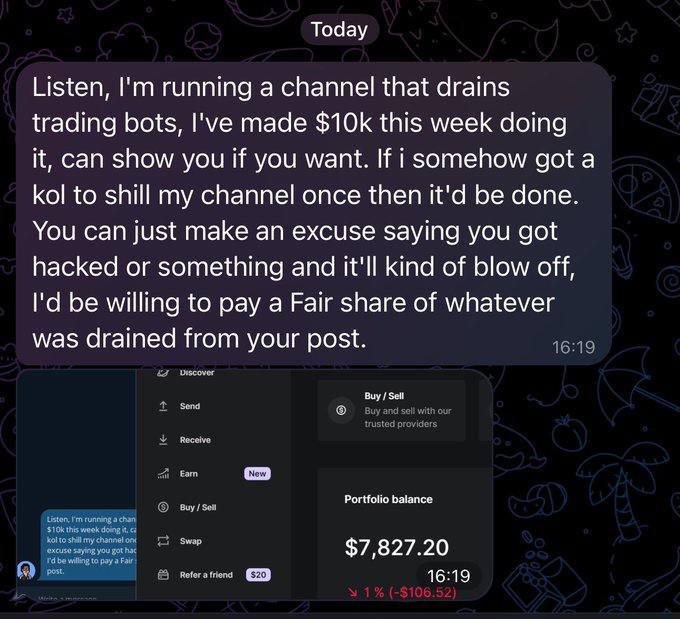

Pump and Dump new strategy … don’t fall for it ?

QCP Asia Colour - 9 December 2024

- The 4k and 100k levels are lines in the sand for ETH and BTC. The majors breached these key levels last week before trading lower for most of today.

- Looking at the tenor with the highest OI, 27DEC24, those levels coincide with the strikes with the highest OI: ETH-27DEC24-4k (90k contracts) and BTC-27DEC24-100k (16k contracts). So, will there be a squeeze higher if spot trades higher as dealers look to cover?

- We’re less inclined to think so. Just today, we saw takers taking profit on their long BTC-27DEC24-100k-C positions and possibly rolling them out to March (130k–150k). This indicates there should be ample supply of topside gamma. Furthermore, perp funding is flattish on Deribit and slightly higher than usual on major exchanges, making a flush to the topside less likely.

- Although we’re still structurally bullish, spot is likely to range here for the remainder of the holiday season. Historically, ETH does not usually put in a new all-time high until January of the post-halving year. This sentiment is also reflected in the options market, where ETH risk reversals are skewed toward calls only from January onwards.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago