Review.uz/en - Economic Review

Editorial team: @CERRUZB

78 150 02 02 (417)

Advertising: 99878-150-02-02 (432)

In English: @review_en

In Uzbek: @reviewuznews

In Russian: @reviewuz

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 2 weeks ago

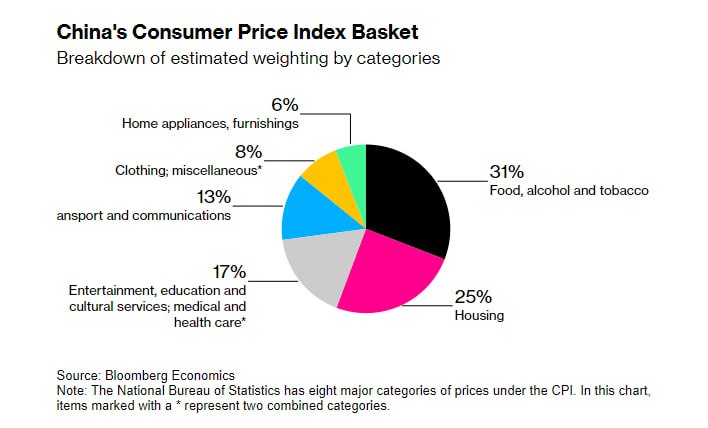

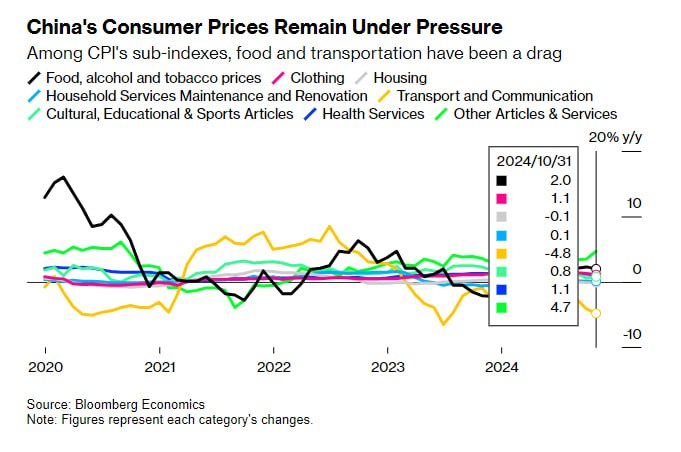

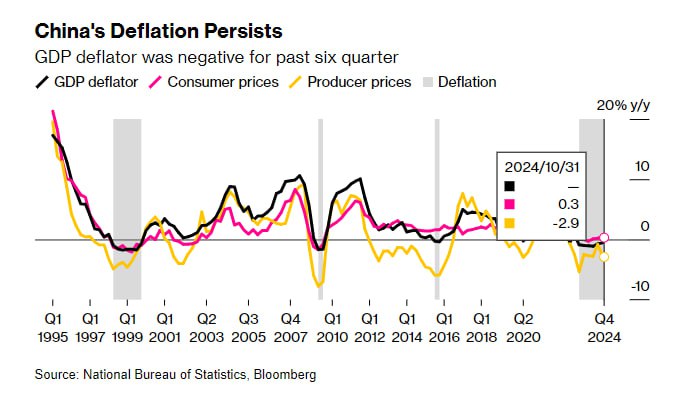

?? What China’s Persistent Deflation Means for the World

Bloomberg reports that China’s spiral into deflation is proving hard to fix.

*?*Prices in the world’s second-biggest economy have fallen for six consecutive quarters, and if they fall for one more quarter, the run would equal a record deflationary streak set in the Asian Financial Crisis in the late 1990s.

?Policymakers have pledged to do more to shore up growth and ease price declines, as Beijing braces for a trade war with Donald Trump’s return to the White House. The US president-elect has vowed to impose a 60% tariff on Chinese exports that would decimate bilateral trade.

*?*Cheaper prices look good for consumers at first, but that doesn’t necessarily mean people will start spending again. In fact, they might hold off from buying expensive items in the hope that prices will fall further. That would depress economic activity even more, putting pressure on incomes, which could result in another dip in spending and further price cuts in a downward spiral.

*?*Deflation also raises the level of “real,” or inflation-adjusted, interest rates in the economy. Higher debt servicing costs make it harder for businesses to invest, which in turn crimps demand, inducing more deflation.

Read full:*⬇️*⬇️**⬇️ en review.uz/en/f0y ru review.uz/f0y

More analytics

⬇️*⬇️*⬇️*© Экономическое обозрение**© Иқтисодий шарҳ**© Economic Review*telegram | facebook | twitter|linkedin

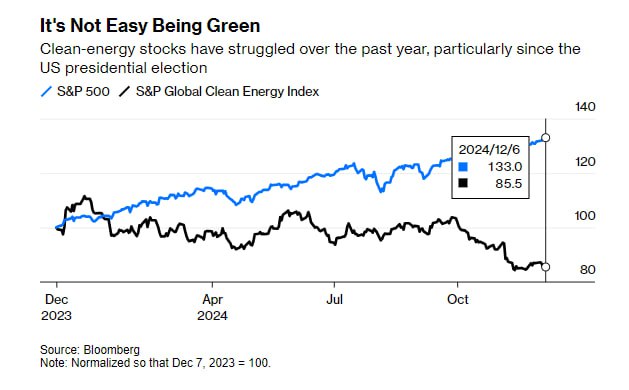

*?*ESG Is in Its Flop Era

Bloomberg reports that despite a pullback amid political hostility, investors and business leaders still recognize that corporate behavior that benefits the environment also benefits the bottom line.

?No doubt, green investments are having a grim year. Investors pulled $24 billion from climate-related funds during the first three quarters of 2024, according to Morningstar data. I’d be shocked if that didn’t get much worse in the fourth quarter, during which “Trump trades” of all kinds, including Bitcoin, have been ascendant.

?Despite the fund outflow, assets in climate-related funds still rose 6% from a year earlier because their prices rose. And ESG funds overall attracted modest global inflows through the first three quarters of the year. The big exception is the US, where investors have been withdrawing money for more than two years.

*?On the other hand, *cleaning up your act is a good way to make money. Stock prices of companies that pledge to reduce their carbon emissions rise “significantly and persistently” after the announcement, according to a Federal Reserve Bank of San Francisco study. The “dirtier” the company making the pledge, the bigger the gain.

Read full:⬇️⬇️⬇️ en review.uz/en/e6e

ru review.uz/e6e

More analytics

⬇️⬇️⬇️*© Экономическое обозрение**© Иқтисодий шарҳ**© Economic Review*telegram | facebook | twitter|linkedin

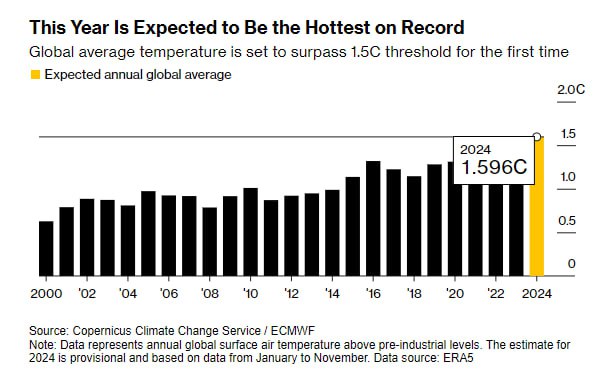

*?*Global Temperature Set to Surpass 1.5C Threshold in Hottest Year on Record

Bloomberg reports that the Paris Agreement has committed countries to make best efforts to keep long-term average temperatures below the key figure to reduce the worst impacts of climate change.

*?The *average global temperature reached 1.62C above pre-industrial levels in November, according to the EU-funded Copernicus Climate Change Service, surpassing the symbolic 1.5C level, a threshold that's become significant because of its inclusion in the Paris Agreement.

?Current pledges and policies are insufficient to limit warming to 1.5 or even 2C above the pre-industrial average, according to the UN. Current commitments put the world on course for temperatures of 2.6 to 2.8C and even these are not being met, it said in a report published shortly before the COP29 climate conference last month.

Read full:⬇️⬇️⬇️ en review.uz/en/1q6

ru review.uz/1q6

More analytics

⬇️⬇️⬇️*© Экономическое обозрение**© Иқтисодий шарҳ**© Economic Review*telegram | facebook | twitter|linkedin

*??* Азиз юртдошлар,

Ўзбекистон Республикаси Конституцияси куни муборак бўлсин!**

Иқтисодий тадқиқотлар ва ислоҳотлар маркази барча ўзбекистонликларни бугунги байрамбилан қутлайди.

Кучимиз – бирлик ва ҳамжиҳатликда, меҳмондўст мамлакатимизга муҳаббатда, фарзандларимизни камолга етказиш ва ота-оналаримизни бахтли кўриш саодатида.

—

*?? *Дорогие друзья!

Центр экономических исследований и реформ* поздравляет всех граждан Республики Узбекистан с Днем Конституции!***

Наша сила в единстве и солидарности, в любви к своей тёплой и гостеприимной стране, в счастье растить детей и видеть родителей рядом.

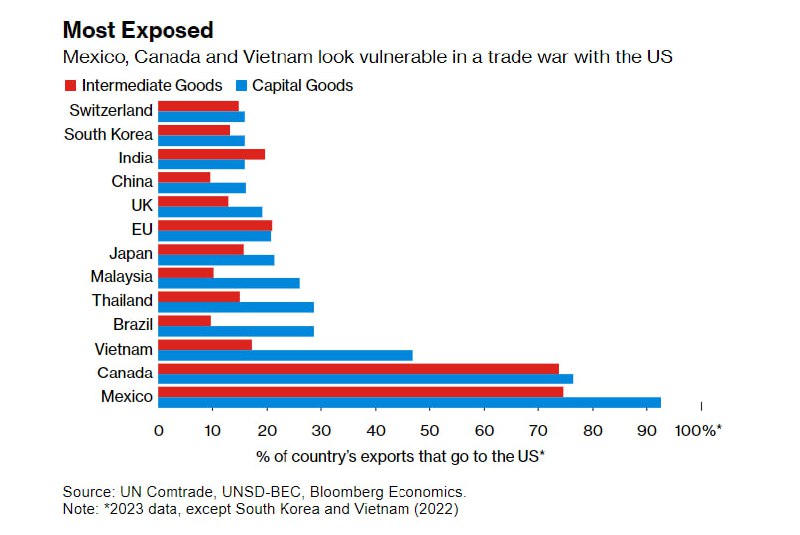

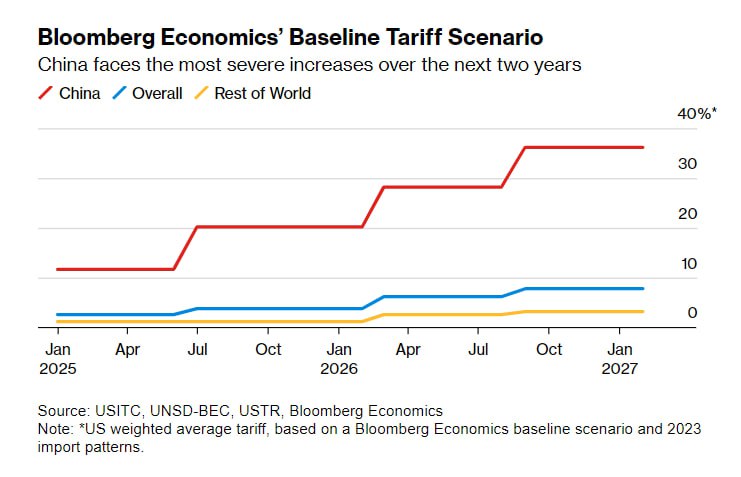

??What Trump’s Next Trade War Could Look Like, a Guide

Bloomberg reports that Trump’s tariffs could go in many different directions. Understanding the strategy from his first term, and the priorities of his new team, reveals a potential path ahead.

?Part of the challenge: separating the drama of Trump’s free-wheeling public statements — like his currency-rattling tariff threats to Mexico, Canada and China and a fresh warning to the BRICS economies on Saturday — from the slower-moving processes by which tariffs are designed and enacted.

?On the road to his Nov. 5 win, Trump suggested he would put a 60% tariff on imports from China and a 10% to 20% fee on goods coming from anywhere else. The import taxes that he will deliver in office, however, seem likely to be sequenced and targeted to maximize negotiating leverage and tariff revenue while shielding US consumers from a return of the inflation that helped elect him.

*?*Bloomberg Economics base case calls for three waves of tariff hikes, starting in summer 2025, with levies on China ultimately tripling by the end of 2026 and a smaller hike on the rest of the world — focused on intermediate and capital goods that don’t directly impact consumer prices. The combined impact would be a tripling of average US tariffs to almost 8% by the end of 2026.

? If that’s how things play out, US imports and exports of goods will drop from 21% of the global total today to 18%, including a plunge in US-China trade. US growth gets dinged, inflation faces fierce cross currents from higher tariffs and a stronger dollar, bullish stock markets have a bearish hurdle to clear and unemployment rises.

? America’s Free-Lunch Economy Is Over

? The World’s Central Banks Aren’t Following the Fed’s Lead Anymore

? Global Economic Risks Should Be Faced, Not Ignored

Read full:⬇️⬇️⬇️ en review.uz/en/a7p

ru review.uz/a7p

More analytics

⬇️⬇️⬇️*© Экономическое обозрение*© Иқтисодий шарҳ

© Economic Review

telegram | facebook | twitter|linkedin

? Overview of the most profitable microloans in Uzbekistan for December 2024? In the microloan segment, the maximum amount was 100 million sums, and the average annual rate increased by 1%. As of December 2024, a microloan can be obtained in 25 banks out of 35.? According to statistics from the Central Bank of Uzbekistan, in 9 months of 2024, banks allocated a total of 31,868.5 billion soums for microloans, which is 53.2% more than in the same period last year.

? Compared with the February overview of last year, the average annual rateincreased by 1% and amounted to 33%, and the interest rates of some banks have changed in the range from +1% to +8% in December this year.

?The following banks do not provide microloans to the population or have temporarily suspended their issuance: Turon Bank, Kapitalbank, AVO bank, Hayot Bank, Uzum bank, Yangi Bank, Smartbank, Saderatbank, Octobank, KDB Uzbekistan.⚡️Which banks and on what terms offer the most favorable terms of microloans — read in our rating:⬇️⬇️⬇️

en review.uz/en/0m1 uz review.uz/oz/0m1 ru review.uz/0m1

More analytics

⬇️⬇️⬇️*© Экономическое обозрение**© Иқтисодий шарҳ**© Economic Review*telegram | facebook | twitter|linkedin

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 4 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 11 months, 2 weeks ago