Scalping Trading

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

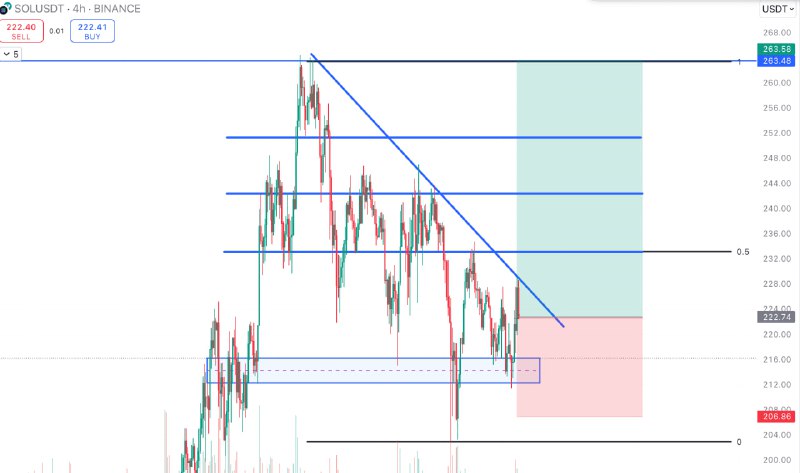

🔥 Trading Signal 🔥

🔸 Coin: #SOLUSDT

🔸 Type: LONG

🔸 Leverage: Your choice

🔸 Position Size: 1% of your capital

🔸 Entry: Limit (222.06)

🔸 DCA: 214.94

🔸 Stop-Loss (SL): 206.86

🎯 Targets:

🟢 TP1: 233.07

🟢 TP2: 242.38

🟢 TP3: 251.26

🟢 TP4: 263.58

⚠️ Always remember proper risk management! Happy trading! 🚀

🔥 Trading Signal 🔥

🔸 Coin: #TAOUSDT

🔸 Type: LONG

🔸 Leverage: Your choice

🔸 Position Size: 1% of your capital

🔸 Entry: Current Market Price

🔸 DCA: 564.6

🔸 Stop-Loss (SL): 546.4

🎯 Targets:

TP1: 599.5

TP2: 616.8

TP3: 637.4

TP4: 664.6

⚠️ Always remember proper risk management! Happy trading! 🚀

? The Difference Between Trading and Investing: What You Need to Know ?

Many people often confuse trading with investing, but these are two fundamentally different approaches to working with assets. While they may seem similar at first glance, they differ greatly in their essence, goals, and strategies. Understanding these differences is crucial to avoid mistakes and navigate the financial world effectively.

? Investing: Buying Assets for the Long Term

Investing involves purchasing assets with the intention of holding them for an extended period. These assets can include real estate, stocks, cryptocurrencies like Bitcoin, and other forms of property. The main idea is to buy an asset and wait for its value to increase over time due to inflation, market changes, or other factors.

With proper diversification, which helps minimize risks, investments almost always yield returns in the long run. This is the primary advantage of investing: you’re putting your money into stable assets that appreciate over time. For long-term investors, things can be simpler—like using the DCA (Dollar-Cost Averaging) model, which involves regularly investing in an asset regardless of its current price. Over time, this strategy is likely to bring positive results.

? Trading: A Business Built on Speculation

Trading, on the other hand, is a business that involves buying and selling assets with the goal of making a profit from price fluctuations. It’s a form of speculation that requires a well-thought-out strategy, market analysis, and the ability to make quick decisions. Trading can be compared to dealing in cars, swimwear, or grain—you also buy assets but with the intention of selling them after a short period when the price changes in your favor.

When people ask me how to find the right entry point in the market, I always respond with a question: "What’s your strategy?" There are many strategies in trading: trading from levels, trend following, identifying overbought or oversold conditions, news trading, breakout trading, pullback trading, and more. Unlike investing, where following a simple DCA model might be enough, trading requires a clear plan and deep market understanding.

? Conclusion

Trading and investing are two distinct approaches to working with assets. Investing focuses on long-term asset holding and earning profits through their appreciation over time. It’s a more stable and less risky way to grow your wealth. Trading, however, is an active form of speculation that demands a clear strategy and readiness for risks. Understanding these differences will help you choose the approach that best suits your financial goals and lead you to success.

---

Know your goals, choose your path, and succeed! ?

? The Impact of Stress on Trading and How to Minimize It ?

Trading is a field where attention to detail is crucial. Every chart, every candle, and every trend can make or break your decisions. However, this intense focus often leads to elevated cortisol levels—our body’s stress hormone—which can negatively impact decision-making.

When cortisol spikes, traders may experience fatigue, anxiety, and even panic. In this state, it becomes challenging to remain objective, and hasty decisions can often lead to losses. So, how can you reduce cortisol levels and improve your decision-making?

? The Power of Hobbies and Active Rest

Here’s where hobbies come into play. Engaging in activities that require focus but are stress-free, such as cooking, dancing, or sports—especially those that involve concentration like rock climbing—not only helps reduce stress but also boosts dopamine production.

Dopamine is the hormone responsible for pleasure and satisfaction. It plays a crucial role in maintaining concentration and motivation. Unlike cortisol, which pushes us to react quickly to threats, dopamine helps keep us calm and focused on tasks that require detailed attention.

? Benefits of Active Rest for Traders

When traders make time for hobbies that involve focused attention without high stress, they gain several key benefits:

-

Reduced Cortisol Levels: Spending time on enjoyable activities helps lower stress and restore emotional balance.

-

Increased Dopamine Production: Active hobbies boost dopamine levels, helping to maintain high motivation and concentration.

-

Mental Reset: Shifting focus to other tasks temporarily allows the brain to "reboot," improving decision-making abilities in trading.

? Conclusion

Trading demands a high level of concentration and attention to detail, which can lead to stress and burnout. That’s why it’s essential to find a balance between work and relaxation by incorporating hobbies into your daily routine. Cooking, dancing, sports—these can all be great ways not only to relax but also to enhance your trading effectiveness.

---

Stay sharp, stay balanced, and happy trading! ?

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 11 months, 2 weeks ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago