Crypto Pills

Owner @TheCrypthusiast

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

Ehy Cryptopills, we are back! ?

Long time no see!

Cryptopills has taken a break to find ways to sustain itself so that it can continue to bring you quality content, such as out daily updates and various weekly reports ( see #TokenReports, #Investigations, and #WeeklyAlpha).

These are the result of a lot of research and effort and the support of several well-chosen contributors who help to keep you informed about all the gimmicks in the crypto industry ?

The simplest solution is to develop a premium club that would allow us to continue to fund our contributors and to create an environment where you can read everything that has happened in crypto, plus our personal takes and deeper thoughts about various topics.

CryptoPills premium club services:

➡️continue to receive daily crypto news updates as before, broken down by topic (Telegram group with sections)

➡️ among these, there will be specific sections where we will write our analysis and thoughts on the topics of the day, including wallet positioning, allocation (majors, alts, memes, stables etc)

➡️ The best twitter takes on events, filtered by us preventing you from searching and reading so much each day

➡️ Analyzing weekly reports from services such as Kaiko, K33 Research and other analysis firms

➡️Having a direct 1:1 chat with us for any thoughts on the market

➡️access to #WeeklyAlpha: reports every Sunday on what happened in the last 7 days and what we can expect from the following week

➡️access to #TokenReports, #InvestmentThesis, #Investigations #TokenUnlocks: detailed reports on crypto products already available or upcoming tokens and specials on major unlocks (e.g. PYTH, ARB)

➡️Weekly summary of news divided by day (example)

➡️Many other things that we will report or comment on!

An example of sections available in the premium club is: Charts and Metrics, Regulation, CryptoPills Alpha, Macro involving Crypto, ETF Flows, Token Unlocking, Speculation, Major Securities, Hacks and Exploits, etc.

The goal is to create a go-to place that is sufficient for everyone to stay on top of all the happenings in crypto ?

The cost of the subscription:?100 x 1 month

?280 x 3 months

?530 x 6 months

?1000 x 12 months

Small gift for the most loyal users:

? the 1,375 users who are already members of the group chat are entitled to a 10% discount on the first billing period of the 3-month sub!

Oh, and there will be a referral system which will also allow us to offer some giveaway opportunities ?

Why purchase the subscription:

? At this point in the cycle we need to get back to being ultra-focused in order to capitalize on the market opportunities that will arise in the coming months.

So, we think the price of this premium service is not that impactful knowing that we have about half or one year maximum before the cycle reaches the top (supposing the previous cycle timing) ✊

How to buy:

☄️ If you wish to explore this further and/or to purchase the subscription, please send a direct message to Eloisa @TheCrypthusiast and she will assist you personally

We hope you guys also feel that this can be a valuable meeting point between you and us, giving us the chance to devote full time to the crypto market for you.

Cheers ??

??? ????

coming for Crypto Pills in the next few hours!

Be on the lookout ?

? FTX Files Consensus-Based Plan of Reorganization: PRNEWSWIRE

(court has yet to approve the plan!)

- FTX forecasts that the total value of property collected, converted to cash and available for distribution will be between $14.5 and $16.3 billion

- The Plan contemplates payment in full of all non-governmental creditors based on the value of their claims as determined by the Bankruptcy Court (11 Nov 2022).

- T. Braziel: Customers < 50k (96% of the customers or 12% of assets - $1b) get 118% back within 60 days of plan confirmation (Q1 2025ish)

- T. Braziel: Customers > 50k (4% of the customers or 88% of assets - $8b) get 118-145% over time via a combination of post-petition interest and sharing in the government fines

- FTX achieved resolution of $24 billion in claims filed by the IRS for periods prior to Chapter 11 cases, in exchange for a $200 million cash payment and a $685 million subordinated claim that will rank below the claims of all creditors and government agencies.

- FTX has proposed an agreement to the Department of Justice under which more than $1.2 billion in forfeiture proceeds can, if the DOJ agrees, will be distributed to customers and creditors through Chapter 11 lawsuits without additional administrative costs or delays.

X (formerly Twitter)

Tree News (@News_Of_Alpha) on X

FTX- OTHER CREDITORS TO RECEIVE 100% OF ALLOWED CLAIMS PLUS BILLIONS IN COMPENSATION FOR TIME VALUE OF THEIR INVESTMENTS - RTRS

We are getting closer and closer to the May 23 deadline for ? Ethereum Spot ETFs.

Some thoughts:

- The likely denial of ETH ETFs has been widely accepted by the market, which has suppressed ethereum's price in recent months. Now, the market's "agreement" that it will be denied has slowly led to a switch in the denial consensus from “sell the news” to “buy the news”: the market now wants to long the denial. Predicting what the final outcome of the chart will be has thus become quite chaotic (I personally think Ethereum is more likely to go upside than downside)

- Consensys' (MetaMask's developer) lawsuit against the SEC had revealed of an ongoing internal investigation since March 2023 against Ethereum 2.0 (ETH migration to proof of staking): This means that several insiders knew from the outset the SEC's intentions regarding possible ETH ETFs that were filed several months down the road

- On May 1, Eleanor Terret revealed that several issuers had “positive” feedback with the SEC on the outcome of proposed Leveraged Futures ETFs on ETH. Should they be approved, while the Spot ETF will be denied, it would provide grounds for a lawsuit exactly like the one Grayscale won last year.

- The presence of ETH on the CME for years, and the correlation analysis of ETH Futures on the CME with ETH Spot on the exchanges done by Bitwise with the SEC methodologies used for bitcoin, reveals that the SEC cannot use that pretext to deny the ETF.

- The SEC with its investigations also in the Ethereum Foundation, seems to be aiming at the presale of ETH in 2014 as an investment contract to prove that ETH is a security according to the Howey test (an opinion article on BlockWorks tries to explain why ETH is not a security). I think the SEC can play this well in court on this ground, and might add that Vitalik and the E. Fundation, to this day, have a big bearing on the future of the network.

? BTC ETFs flows May, 06

2nd consecutive (and 2nd ever) GBTC inflow: +$3.9mBlackrock: +$21.5mFidelity: +$99.2mBITB: +$2.1mARKB: +$75.6mBTCO: +$11.1mEZBC: +$1.8mHODL**: +$1.8m

Netflow: +$217m ?**

X (formerly Twitter)

Tree News (@News_Of_Alpha) on X

[Tree] Grayscale (GBTC) Daily BTC Flows: +3.9m

CPI: 3.5%

CPI Core: 3.8%

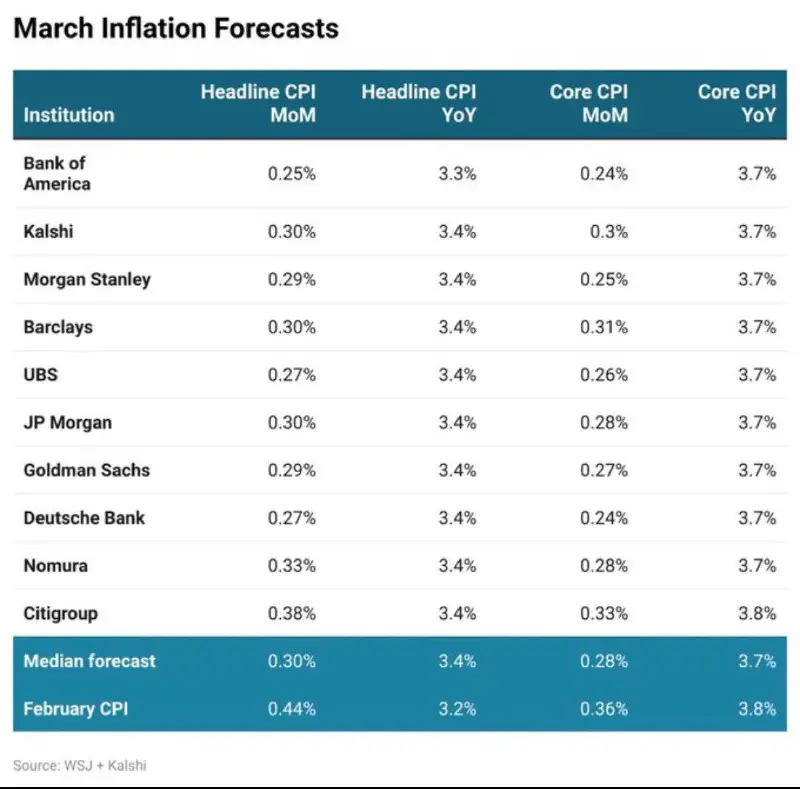

In less than 10 minutes the March ?? US CPI data will be released.

Important to understand when the FED may start cutting rates

Expectations about the first cut have shifted to June or July. State Street's ($3.6T AuM) prediction of a 50-points June cut and a 150-points cut by the end of the year (wow!) made headlines yesterday: Bloomberg

CPI

previous: 3.2% - forecast: 3.4%

CPI Core

previous: 3.8% - forecast: 3.7%

My view (NFA):

CPI < 3.4: bullish

CPI = 3.4 neutral/bad

CPI > 3.4 bearish af

CPI Core < 3.7: bullish af

CPI Core = 3.7: neutral/good

CPI Core > 3.7: bearish af

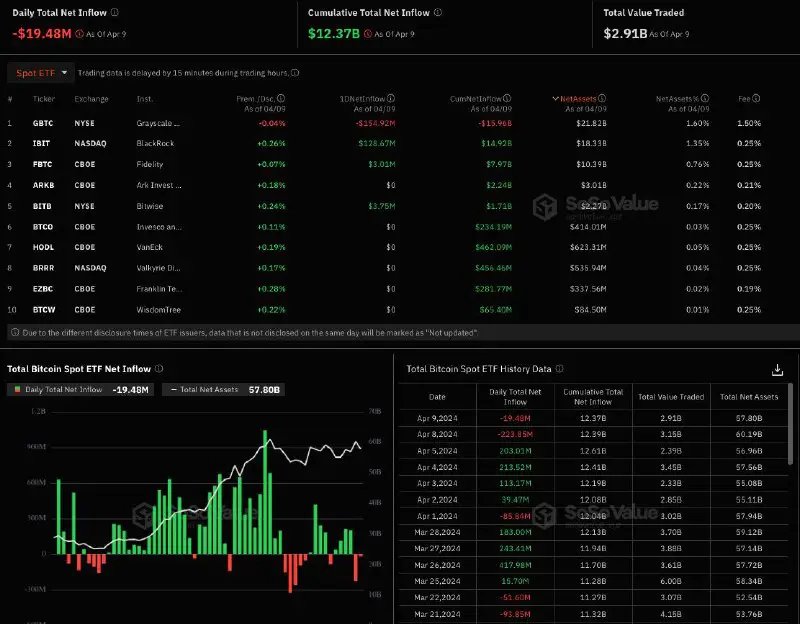

*? *Bitcoin ETF Flows April 9

https://sosovalue.xyz/assets/etf

Fidelity keeps sleeping like Monday with just +$3m of inflows. Thankfully, BlackRock with +$128m mitigated the $155m outflow from GBTC. Daily netflow along with the other ETFs of -$18.6m. (Farside also reports +$0.8m from Hashdex ETF $DEFI which SoSoValue does not show in their table).

Not good but not bad either. Neutral day

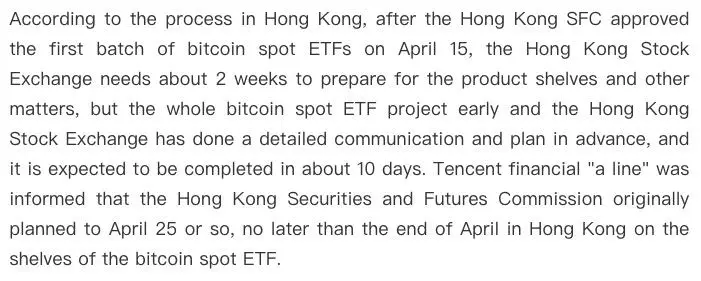

HongKong is set to approve its first ? bitcoin ETFs on April 15, should be able to start trading within 10/14 days: Reuters - Tencent News

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago