Finance | Trading Tips | Stock Marketing | IPO Allotment | Investment Banking

Buy ads: https://telega.io/c/Finance_Stock_Trading

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

Today’s IPO Events

𝗖𝗹𝗼𝘀𝗶𝗻𝗴 𝗧𝗼𝗱𝗮𝘆

Solarium Green

Readymix Construction

𝗢𝗽𝗲𝗻𝗶𝗻𝗴 𝗧𝗼𝗱𝗮𝘆

Ajax Engineering (M)

Chandan healthcare

𝗢𝗻𝗴𝗼𝗶𝗻𝗴

Eleganz Interiors

𝗔𝗹𝗹𝗼𝘁𝗺𝗲𝗻𝘁

Ken Enterprises

Amwill Healthcare

𝗥𝗲𝗳𝘂𝗻𝗱/𝗖𝗿𝗲𝗱𝗶𝘁

Chamunda Electrical

The List Of Companies which Have Recieved SEBI Approval for IPO :

- Gold Plus Glass

- Patel Retail Limited

- Belstar Microfinance

- SK Finance Limited

- Shivalik Engineering

- NSDL

- Paras Healthcare

- Avanse Financial Services

- Rubicon Research

- Metalman Auto

11.Kalpataru Limited

12.TruAlt Bioenergy

13.Ecom Express

14.Smartworks Coworking

15.Ivalue Infosolutions

16.Ather Energy Limited

17.Oswal Pumps

18.Fabtech Technologies

19.Schloss Bangalore (Leela Hotels)

20.Casagrand Premier Builder

21.Highway Infrastructure

22.Regreen Excel EPC India

23.JSW Cement

24.PMEA Solar Tech Solutions

25.Vikran Engineering

26.Scoda Tubes

27.All Time Plastics

28.Ellenbarrie Industrial Gases

29.Sambhv Steel Tubes

30.Varindera Constructions

31.SMPP Limited

32.Aditya Infotech

33.Brigade Hotel Ventures

34.Kumar Arch Tech

35.Solarworld Energy Solutions

36.IndoGulf Cropsciences

37.Prostarm Info Systems

38.Globe Civil Projects

IPO Approved By SEBI With Shareholder Quota.

▪︎ Ather Energy Limited

(Hero Motocorp Limited)

▪︎ Brigade Hotel Ventures Limited

(Brigade Enterprises)

The richest men in the world are:

75% Entrepreneurs

15% Investors

7% Athletes

3% Artists

Enviro Infra IPO Allotment Out

IPO Events for Today

? Tuesday, 26 November 2024

? Closing Today

⭐️ Enviro Infra Engineers IPO (Mainboard)

⭐️ C2C Advanced System SME IPO

⭐️ Lamosaic India SME IPO

? Opening Today

⭐️ Rajputana BioDiesel SME IPO

No IPO Listings Today

IPO Events for Today

?️ Monday, 25 November 2024

? Second Day

⭐ Enviro Infra

⭐ C2C Advanced System SME IPO

⭐ Lamosaic India SME IPO

? Opening Today

⭐ Rajesh Power SME

No IPO Listings Today

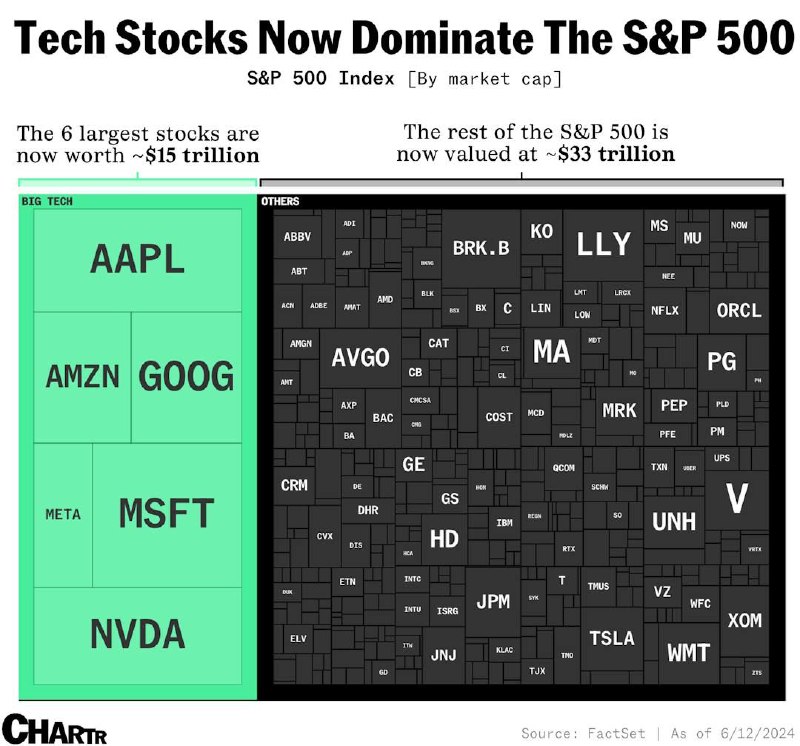

Tech stocks now dominate the S&P 500

Good Buying Demand in Enviro Infra IPO

Latest GMP 29

Opening High 30

No trading guru can make you a profitable trader.

But your attitude, mindset, and perseverance will.

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 1 year ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago