WhiteSwap | Whitestarter

Network:

✓ Tron

✓ Ethereum

✓ Polygon

✓DEX

✓Decentralized launchpad

✓ AMM

✓ DAO

✓ Governance token WSD

Official site:

https://ws.exchange/?utm_source=telegram

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

*? CBDC will replace Stablecoins*

Ok, that’s not for sure. But it can be the case. At least the U.S. Treasury intends to replace private stablecoins with a central bank digital currency (CBDC) because it sees significant financial stability risks in the current stablecoin model — recent U.S. Treasury Report.

Stablecoin issuers like Tether have accumulated large holdings of U.S. Treasuries to back their digital currencies, and the Treasury is concerned that if a major stablecoin were to depeg or collapse — a "common occurrence" in recent years — it could trigger a rapid sell-off ("fire sale") of these Treasuries ?

On one hand, crypto enthusiasts are generally skeptical about CBDC, because it’s not decentralized. But one the other hand, is Tether decentralized? It is also controlled by a single issuer with questionable reserves, and it can even block USDT tokens on certain addresses on a request of authorities.

? Anyways, the US plans for stablecoins will largely depend on the election results. The current report was published under the Democrats. Trump, on the contrary, opposes CBDCs and supports private stablecoins. So, let’s see.

Meanwhile, this is what we have for now on the crypto market:

? Crypto market cap: ≈$2,36 T

? BTC Dominance: ≈58.9%

? Fear & Greed Index: 75 (Greed)

CBDCs are a very interesting topic. Let’s discuss it on Discord.

Website | Telegram ENG | Twitter | Discord | Telegram Asia

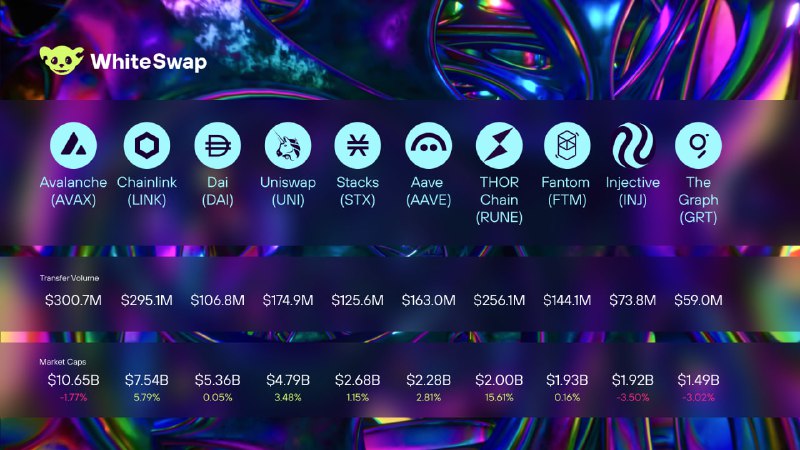

*? TOP-10 DeFi this week (October 23-30)*

- The DeFi market has gone up, compensating for the decline of last week.

- While DeFi remains a volatile market on a daily and weekly basis, it is now one of the most stable sectors on a multi-month basis.

- However, this is far from the ATH. While Bitcoin breaks new ceilings, DeFi tokens are still nostalgic for 2021.

A good time for day trading.

Website | Telegram ENG | Twitter | Discord | Telegram Asia

*? BlackRock Seeks to Strengthen Its Position in the Crypto Derivatives Market —* Bloomberg

They want exchanges to use its BUIDL token as collateral for derivatives trading. Negotiations are already underway with several crypto exchanges. According to sources, the exchanges include Binance, OKX, and Deribit.

? BlackRock is the world's largest investment company specializing in asset management and investments. To date, BlackRock manages more than $10 trillion in assets, which includes stocks, bonds, real estate funds, commodities, and other asset classes. Managing large stakes in the largest companies also allows them to influence them and have great economic and even political influence.

The company has already firmly entered the cryptocurrency market. It has cryptocurrency on its balance sheet, and also manages the largest Bitcoin ETF — $IBIT with a capitalization of more than $26 billion.

The introduction of its own token will give BlackRock even more influence in the crypto industry and entails the risks of centralization.

Let's hope that exchanges realize this and will not sacrifice their reputation ?

Meanwhile, this is what we have for now on the market:

? Crypto market cap: ≈$2,31 T

? BTC Dominance: ≈57.8%

? Fear & Greed Index: 56 (Neutral)

What do you think, will BUILD be implemented or not? Join the discussion on Discord.

Website | Telegram ENG | Twitter | Discord | Telegram Asia

? Let’s play a game in the comments. You need to create a continuous chain of cryptocurrency names.

Find the last cryptocurrency in the comments and write the cryptocurrency that starts with the last letter of the previous comment.

For example: Bitcoin — Near — Render...

I'll start. WhiteSwaP.

Website | Telegram ENG | Twitter | Discord | Telegram Asia

*? TOP-10 DeFi this week (October 16-23)*

- The DeFi market fell a bit this week, correcting the recent local pump.

- Jupiter (JUP) is a bright exception. In the last 7 days, it has grown by 17% after launching a new round of staking.

- But in general, the tokens have been trampling in place for the entire last month.

Will the consolidation drag on again for a whole year, as it was in 2022-2023?

Website | Telegram ENG | Twitter | Discord | Telegram Asia

*? It's time to take stock of the week (October 11-18)*

The State of Crypto Report 2024 is here, and it’s packed with insights. This is perhaps the largest piece of crypto stats this year, wrapped in infographics. We read it entirely and enjoyed it. So, here are some key insights.

*? Crypto Activity Soars*

September 2024 hit 220 million monthly active crypto addresses — tripling since last year! Solana leads with 100 million, followed by NEAR, Base, and Bitcoin. Plus, 29 million mobile wallet users are driving global adoption, especially in Nigeria, India, and Argentina.

*? Crypto Enters the Political Spotlight*

With elections approaching, crypto is now a hot topic in swing states like Pennsylvania and Wisconsin. The SEC’s approval of Bitcoin and Ethereum ETPs and bipartisan laws like the FIT21 Act are paving the way for clearer regulations and more investment opportunities.

*? Stablecoins Find Their Sweet Spot*

Stablecoins saw $8.5 trillion in transactions and 1.1 billion transfers in Q2 2024. Fees for USDC dropped to $1 on Ethereum and less than a cent on Base, compared to $44 for international wires. They now make up 32% of daily crypto usage.

*? Infrastructure Upgrades Power Growth*

Blockchain networks now handle 50x more transactions per second thanks to upgrades like Ethereum’s “Dencun” and Layer Two (L2) networks. Zero-Knowledge (ZK) proofs are cheaper and more efficient, boosting scalability and privacy.

*? DeFi Continues to Thrive*

DeFi has over $169 billion locked in protocols, with DEXs handling 10% of spot trading. Since Ethereum’s switch to proof-of-stake, 29% of Ether is staked, enhancing security and sustainability.

Every year is better for the industry than the previous one. The number of users and addresses grows, fees are reduced, transactions are accelerated. More tokens and technological solutions appear. More and more businesses accept cryptocurrencies for payment.

So what difference does it make in the end how much Bitcoin costs? Right? Right???

Anyways, this is what we have for now on the market:

? Crypto market cap: ≈$2,33 T

? BTC Dominance: ≈57.7%

? Fear & Greed Index: 73 (Greed)

What do you think about this? Let's discuss on Discord

Website | Telegram ENG | Twitter | Discord | Telegram Asia

Vitalik Buterin has published two articles from the “Possible futures for the Ethereum protocol” series. And they are definitely worth your attention.

*? Part 1: The Merge ?*** Part 2: The Surge

Here are some key points for those who don’t want to read the entire article:

⚡️ Ethereum's next goal is single-slot finality, reducing finalization time from 15 minutes to 12 seconds while enabling smaller validators to participate.

⚡️ One approach to achieving single-slot finality is "Orbit committees," which use a medium-sized validator committee to improve efficiency without sacrificing economic finality.

⚡️ Reducing Ethereum's staking minimum from 32 ETH to 1 ETH could democratize staking, increasing solo staker participation.

⚡️Single Secret Leader Election (SSLE) aims to prevent attackers from identifying block proposers in advance, reducing the risk of DoS attacks.

⚡️ Faster transaction confirmation, ideally reducing slot times to 4-8 seconds, could significantly improve the user experience and efficiency of both L1 and rollups.

⚡️ Ethereum is exploring further research areas like 51% attack recovery, increasing the quorum threshold for finality, and developing quantum-resistant cryptography for long-term security.

⚡️ The Surge aims to achieve over 100,000 transactions per second (TPS) across L1 and L2, while preserving decentralization and security.

⚡️ Data compression techniques, such as zero-byte compression and BLS signature aggregation, could further increase Ethereum's transaction throughput.

⚡️ Plasma systems and hybrid rollup-Plasma models can enhance scalability for high-volume, low-value applications.

But if you are interested in cryptocurrency (especially the technical part), we recommend reading the entire article when you have time. There is still a lot of interesting stuff there that cannot be contained in one post.

Website | Telegram ENG | Twitter | Discord | Telegram Asia

*? TOP-10 DeFi this week (October 9-16)*

- The overall dynamics of the DeFi market this week are positive.

- However, this did not help the Trump family token (WLFI). The project managed to sell only 687 million tokens out of the planned 20 billion.

- But the Ethena (ENA) Governance token was luckier. It grew by 42% due to the influx of whale investments after successful offers.

Time to trade?

Website | Telegram ENG | Twitter | Discord | Telegram Asia

*? It's time to take stock of the week (October 4-11)*

The real Satoshi Nakamoto is finally revealed! Or not?

? HBO just dropped a bombshell with their latest documentary Money Electric: The Bitcoin Mystery, where director Cullen Hoback claims to have solved one of the biggest mysteries of the internet age — who Satoshi Nakamoto really is. According to Hoback, it’s Peter Todd, a well-known Bitcoin core developer.

He had long been on the list of those the community suspected, so the film did not put forward a new theory, but only confirmed the guess.

? Todd quickly denied the claims, accusing the film of being “irresponsible” and putting his safety at risk.

Todd stated, “For the record, I’m not Satoshi,” slamming Hoback’s documentary as conspiracy fodder and criticizing HBO for not offering him a chance to screen the film. Meanwhile, Hoback doubled down, asserting Todd’s reaction is proof enough and emphasizing that Todd had “every opportunity” to clarify his role.

On the other hand, what else could he say? Just confirm that he is the real Satoshi? Of course, he wouldn’t reveal himself so easily ?

Whether it’s a clever marketing move or genuine investigative journalism, one thing’s for sure: Bitcoin’s founding mythos just got a lot more intriguing.

Meanwhile, this is what we have on the market right now:

? Crypto market cap: ≈$2,15 T

? BTC Dominance: ≈56.6%

? Fear & Greed Index: 32 (Fear)

So, do you think Peter is the Satoshi? Share your thoughts on Discord!!

Website | Telegram ENG | Twitter | Discord | Telegram Asia

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago