貝殼街倉庫

Global equities were net sold for the first time in 3 weeks and at the fastest pace in 7 months, driven by short sales outpacing long buys 2.5 to 1 – this week’s notional short selling in global equities was the largest in more than 10 years.

Both Macro Products and Single Stocks were net sold and made up 87% and 13% of the total notional net selling, respectively, both led by short sales.

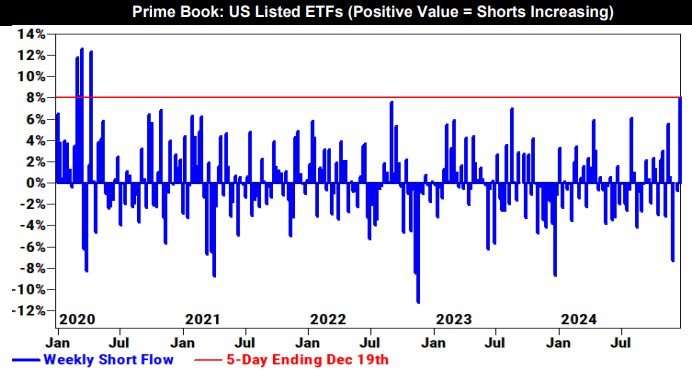

In cumulative notional terms, the short selling in US equities over the past 4 sessions is the largest since early January and ranks in the 100th percentile on a 5-year lookback.

ETF shorts increased 8% week/week, which is the largest % increase since April of 2020, led by shorting in Large Cap Equity ETFs.

U.S. EQUITIES COLOR: DIGESTING Today was a much less eventful trading session as the market continues to digest yesterday’s surprisingly hawkish tilt from the Fed. Earnings didn’t help broader mkt sentiment as MU closed -16% after reporting very weak guidance…

U.S. EQUITIES COLOR: DIGESTING

Today was a much less eventful trading session as the market continues to digest yesterday’s surprisingly hawkish tilt from the Fed. Earnings didn’t help broader mkt sentiment as MU closed -16% after reporting very weak guidance driven by an inventory correction in certain end markets. Semis traded -156bps in sympathy. Housing stocks also underperformed after LEN -5% acknowledged a weaker than anticipated housing market due to elevated rates, and warned of continued margin pressure. We are beginning to get more questions on dollar stores again after having gone quiet there for a while. DG has drawn in the most confusion, the last 2 days especially. A ton of inbounds on today’s -2.7% move but we think it’s just reversion and it being back to focusing on fundamentals.

The one bright spot was megacap tech in a clear “flight to safety” from institutional community after yesterday’s move lower. Our Megacap Tech basket closed +50bps and we saw notable LO demand in high quality megacap names like MSFT/META/GOOGL. Yields continue to climb higher with the 10yr testing 4.60 to the upside putting pressure on growthier pockets of the market.

Tomorrow will be the last major liquidity event of the year as the S&P Quarterly Rebalance coincides with Triple Witching (options and futures expirations). On average over the past ten years, US composite Equity volumes on December Rebalances have increased by +70% vs. full year ADV. Among Quarterly Rebalances, Q4 Rebalances are nearly 13% larger than previous quarters (Q1-Q3) averages in the last 10 years. Tomorrow also marks the unofficial start of the corporate buyback blackout window. As a reminder, we estimate ~$6bn in vwap style daily demand that will be pulled in the heart of the blackout window.

Our floor was a 4 on a 1-10 scale in terms of overall activity levels. Flows skewed better for sale across our system. LOs finished -$300mm net sellers. HFs finished -$800 net sellers, driven by supply in macro products and short supply.

U.S. EQUITIES COLOR: HAWKISH SURPRISE SPX closed -295bps in its worst performance on a post FOMC announcement trading day since March 2020 and the index’s second worst trading day of the year (behind Vol explosion on Aug 5 // finished down 3%). RTY closed…