Glassnode

Advanced charts/data/insights for investors in Bitcoin and digital assets.

https://studio.glassnode.com/

@notcoin_bot

@notcoin_fam

Last updated 2 days, 13 hours ago

🧊 @community_bot is a Telegram-native toolset for communities.

📝 Overview & beta access: t.me/community_bot/beta

💬 Chat: @communitieschat

Last updated 1 week, 2 days ago

This channel gives the best growth to NFT & Crypto projects. Turn on notifications to be the first to see the announcement🚀

Owner: @Legend

Official Partners @monsterra_official, @bcgameofficial, @BitMartExchange @DogeMob

Last updated 2 weeks, 4 days ago

The Week On-Chain 16, 2024

The Ethereum community is debating a change to the ETH monetary policy, following a proposals aimed at constraining the rapid expansion of the staking pool. This is motivated by a surge in demand for Liquid Staking and Restaking protocols.

Executive Summary

- The Ethereum community is currently engaged in a heated debate regarding the ETH monetary policy following proposals to reduce the ETH issuance rate.

- New innovations such as Liquid Staking, Restaking, and Liquid Restaking have introduced additional yield opportunities, significantly boosting staking demand.

- Concerns are that the increasing prevalence of staking derivatives may dilute Ethereum's function as money, and shift the governance power of the network.

Read more in The Week On-Chain newsletter.

In just two days, the Bitcoin halving will reduce the block reward from 6.25 BTC to 3.125 BTC.

As detailed in our Q2 Guide to Crypto Markets, Bitcoin's price increased by 1,000%, 200%, and more than 600% in the 12 months following each of the previous halvings.

Will the upcoming halving have a similar effect? Dig deeper into this topic in the first article of our 'Spotlights' series, which will highlight key insights and critical market trends and events detailed in the Q2 Guide. 👇

https://glassno.de/3UlfFMM

Introducing the Q2 Guide to Crypto Markets by Coinbase Institutional and Glassnode.

This second instalment analyzes price trends and key themes in the digital asset landscape in 2024.

Some highlights from the 59-page guide:

- Data on the bull: The last two bull markets lasted 3.5 years; currently, we're 1.5 years into another. Previously, price increases reached 113x and 19x, with this cycle ‘only’ reaching 4x so far.

- Rising popularity, rising maturity: As the crypto market grows, spot Bitcoin ETFs boost accessibility for institutional investors. Last quarter, they attracted $12B and now hold $60B in BTC, becoming key market influencers and among the fastest-growing ETFs.

- The perfect diversifier? From April 2019 - March 2024, adding a small crypto allocation to a traditional 60/40 portfolio notably boosted returns: a 3% allocation yielded 52.9% returns, & a 5% allocation brought 67.0%, far surpassing the traditional strategy’s 33.3% returns.

Download the guide here: https://glassno.de/3VUhtxx

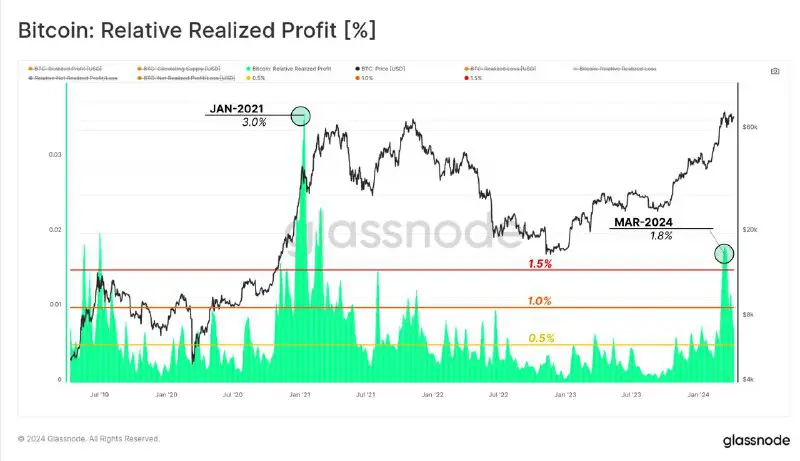

As the market reclaimed the 2021 cycle high, the Bitcoin Relative Realized Profit peaked at 1.8%, suggesting 1.8% of the market cap was locked in as profit over a 7-day period.

This is significant but remains comparatively lower than the profit-taking intensity during the January 2021 rally (3.0%.)

Discover more in the latest Week On-Chain below 👇

https://glassno.de/43OJxEt

This month's Finance Bridge examines the role of ETF inflows and wealth transitions in Bitcoin'srise, along with the ramifications of Ethereum's upgrade. The analysis includes a look at market momentum indicators and speculative trends as the Bitcoin halving approaches. A crucial read for finance professionals and institutional investors in the digital asset market.

Read the full article here: https://glassno.de/3VR40qg

Glassnode Insights - On-Chain Market Intelligence

Finance Bridge: Approaching the Halving

In our April 2024 Finance Bridge, we look at the rise of Bitcoin's volatility in the past month through the lens of on-chain analytics. We also provide a status update on Glassnode's Momentum Signal framework.

The Week On-Chain 15, 2024

In this edition, we analyse the surge in both spot trading, and onchain exchange volumes for Bitcoin underlying the strong YTD performance. The market has also transitioned into a euphoric phase, as profit-taking has climbed accordingly.

Executive Summary

- Bitcoin’s strong performance over the last 12 months is supported by a surge in both spot trade volume but also exchange deposit and withdrawal volumes.

- By inspecting the cumulative volume delta (CVD), we can see that a majority of 2023 saw net selling activity on the taker side, even though corrections have been historically mild and less than 20%.

- Profit taking by long-term holders spiked meaningfully into the $73k ATH and is cooling down in recent weeks. This comes alongside an uptick in new demand brought on by the US spot ETFs.

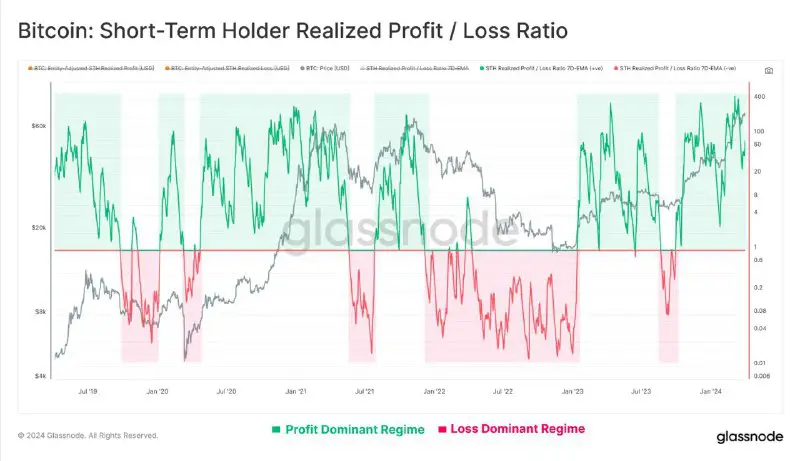

Assessing the Bitcoin Short-Term Holders, we can see that their Profit / Loss ratio remains well within a profit dominated regime, with profit taking outsizing losses by 50x.

Regular retests of the equilibrium level of 1.0 suggests that profits are being absorbed, and investors are generally defending their cost basis during corrections.

Discover more in the latest Week On-Chain below 👇

https://glassno.de/3VLKLOH

If we segregate the Bitcoin Realized Cap for coin-ages younger than 3 months, we can see a sharp increase over recent months, with these newer investors now owning ~44% of the aggregate network wealth.

This uptick in younger coins is a direct result of Long-Term Holders spending their coins at higher prices to satisfy the wave of inflowing demand.

Discover more in the latest Week On-Chain below 👇

https://glassno.de/3VLKLOH

The Week On-Chain 14, 2024

As the Bitcoin Spot Price consolidates below the new ATH of $73k, the Long-Term Holder cohort has entered their distribution phase, selling to new investors at higher prices. This represents an injection of new capital into the asset class, driving the realized cap up to new heights.

Executive Summary

- Capital continues to flow into Bitcoin, with the Realized Cap rising to a new high of $540B, and seeing rates of capital inflow into the asset now exceeding $79B/month.

- The transfer of wealth from Long-Term Holders back to new demand is accelerating, with over 44% of the network wealth now owned by coins aged less than 3 months old.

- Profit taking continues to dominate investor behavior, with both the Long and Short-Term Holder cohorts taking chips off the table. Overall profit dominance is however shifting towards the Long-Term Holders.

Read more in The Week On-Chain newsletter.

In this week's Glassnode Clips, we analyse the GBTC Balance:

- GBTC's market impact is notable, with its transition from a closed-end fund to an ETF enabling share redemptions and significantly influencing Bitcoin's market dynamics, especially during the shift to a discount phase.

- The conversion of GBTC to an ETF led to significant Bitcoin outflows, including around 161,000 Bitcoin, largely due to redemptions and ETF fees.

- The ongoing market dynamics from GBTC's transition are still unfolding, with substantial outflows suggesting a shift of coins to other ETFs and a relatively modest market correction observed so far.

Discover more in the latest Glassnode Clips below 👇

https://www.youtube.com/watch?v=KS-1FvqLH0Y&t=2s

YouTube

GBTC Balance Analysis - Glassnode Clips

In this Glassnode Clips, we analyze the GBTC (Grayscale Bitcoin Trust) Balance and its impact on the Bitcoin market. The focus is on GBTC's transition from a closed-end fund to an ETF, which enabled share redemptions and significantly influenced market trends.…

@notcoin_bot

@notcoin_fam

Last updated 2 days, 13 hours ago

🧊 @community_bot is a Telegram-native toolset for communities.

📝 Overview & beta access: t.me/community_bot/beta

💬 Chat: @communitieschat

Last updated 1 week, 2 days ago

This channel gives the best growth to NFT & Crypto projects. Turn on notifications to be the first to see the announcement🚀

Owner: @Legend

Official Partners @monsterra_official, @bcgameofficial, @BitMartExchange @DogeMob

Last updated 2 weeks, 4 days ago