Glassnode

Advanced charts/data/insights for investors in Bitcoin and digital assets.

https://studio.glassnode.com/

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago

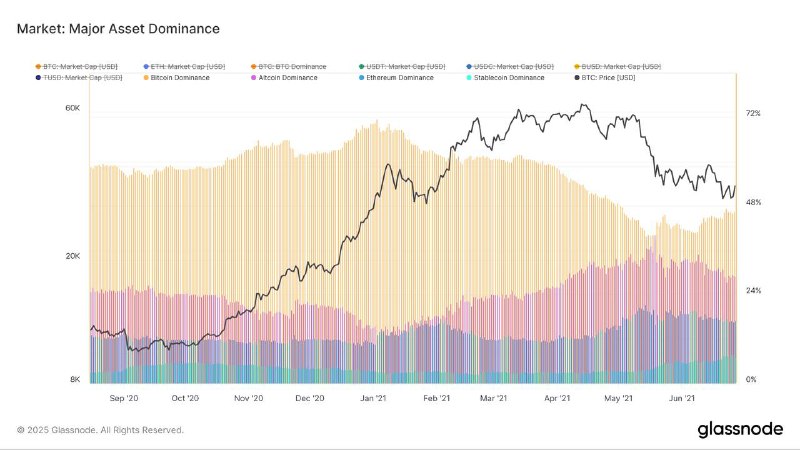

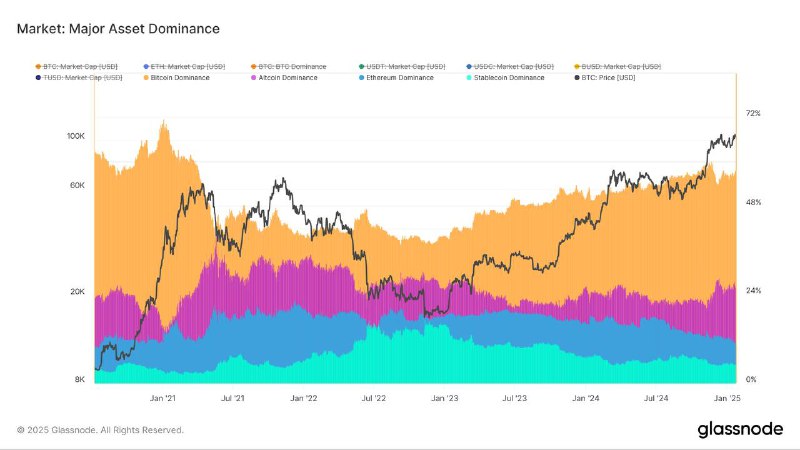

Bitcoin dominance is climbing againAfter bottoming in December 2024 at ~54%, BTC dominance has surged past 57% in January 2025.

This mirrors the 2020 cycle, where BTC dominance bottomed in Nov '20 (~60%), then rallied to 69% in Jan '21 before starting to decline again.

In the last cycle, Bitcoin dominance peaked near 72%. Shortly after, BTC hit ~$40K - over 2x its prior cycle's ATH - but still far from the eventual $64K top. Dominance began dropping as BTC's price soared, signalling a shift in risk appetite toward riskier assets.

View Major Asset Dominance 📈

The Week On-Chain, Week 3, 2025Following two months of consolidation, Bitcoin has broken upwards from its rangebound conditions and surged to a new ATH of $109k. In this article, we evaluate the conditions leading into this move to demonstrate signals of impending volatility.

**Executive Summary

🔸**Capital flows into Bitcoin remain positive, although they have declined in magnitude since first reaching $100k. This highlights a period of declining sell-side pressure as the market approaches a near-term equilibrium.

🔹Sell-side pressure from long-term investors has also declined, alongside volumes deposited to exchanges for sale.

🔸Several measures of volatility are tightening up, with the market trading within a historically narrow 60-day price range, often a sign that the market is almost ready to move again.

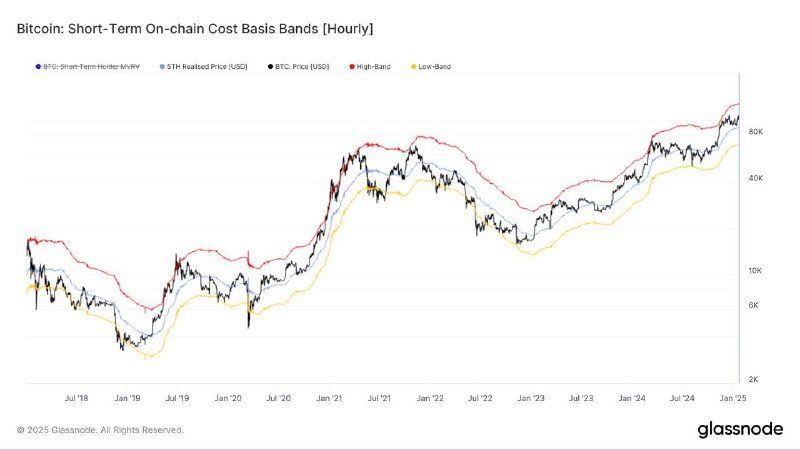

At the moment, $125K marks the current upper limit of Bitcoin’s Short-Term Holder (STH) price action in bull market conditions, derived from an optimized framework using the STH cost basis ($88,517) as the baseline.

This approach accounts for Bitcoin’s evolving market conditions and shows that, in previous cycles, Bitcoin did not top before reaching this upper band - though it sometimes exceeded it temporarily.

In March 2024, the market tagged this level intra-cycle.

Currently, Bitcoin trades at $105,094 - 18.7% above the STH cost basis and well within bullish norms. However, if the price drops below $88,517, unrealized losses could trigger increased sell-side pressure.

Key thresholds for STHs:

- $125,653: Current upper band (bull market extremes).

- $88,517: Average cost basis.

- $68,549: Lower band (bear market lows).

As the STH cost basis rises, the upper band will adjust dynamically. Explore this chart here: https://glassno.de/4arR3bq

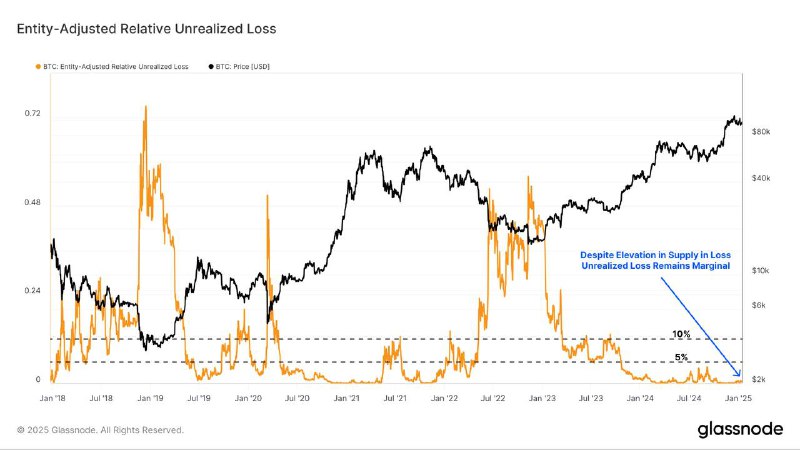

? Bitcoin Supply in Unrealized Loss: Insights into Market Stress

Historically, the number of $BTC held in unrealized loss provides a reference point for assessing market stress:

? Bull markets: <4M BTC in loss. ? Early bear markets: 4–8M BTC in loss.

Last week, market volatility pushed 2.0–3.5M BTC into loss, still lower than the 4M BTC seen during mid-2024 lows.

For context: ? 2018 bear market: 10.7M BTC in loss. ? 2020 COVID crash: 10.4M BTC in loss.

? Another view: The Relative Unrealized Loss metric (unrealized losses relative to market cap) peaked at ~4.3% in Q3 2024 - far below the 10%+ levels seen during past external shocks like COVID or the 2021 China mining ban.

This highlights a more resilient market structure in the current cycle.

? Dive deeper into the data here:

Total Supply in Loss

Entity-Adjusted Relative Unrealized Loss

Community chat: https://t.me/hamster_kombat_chat_2

Website: https://hamster.network

Twitter: x.com/hamster_kombat

YouTube: https://www.youtube.com/@HamsterKombat_Official

Bot: https://t.me/hamster_kombat_bot

Last updated 12 months ago

Your easy, fun crypto trading app for buying and trading any crypto on the market.

📱 App: @Blum

🤖 Trading Bot: @BlumCryptoTradingBot

🆘 Help: @BlumSupport

💬 Chat: @BlumCrypto_Chat

Last updated 1 year, 5 months ago

Turn your endless taps into a financial tool.

Join @tapswap_bot

Collaboration - @taping_Guru

Last updated 1 year ago